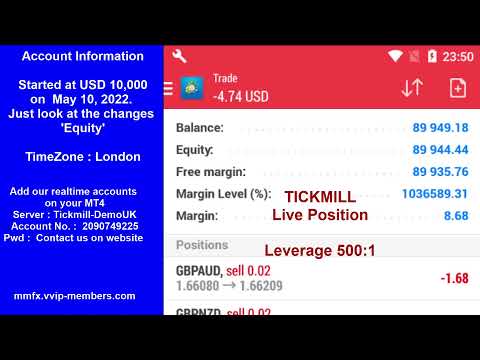

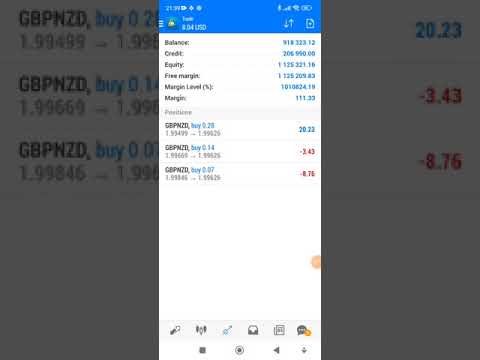

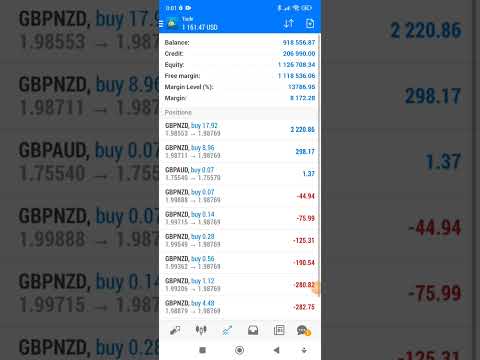

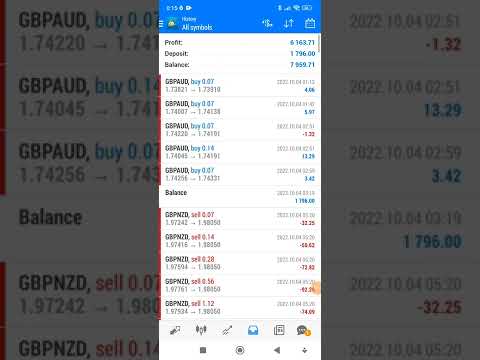

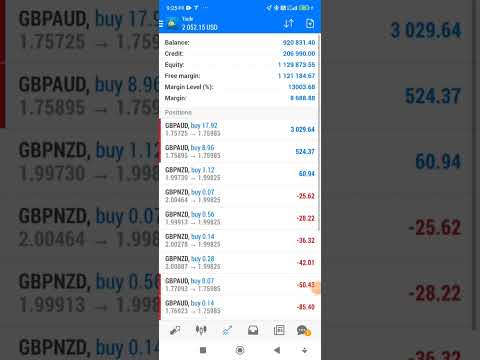

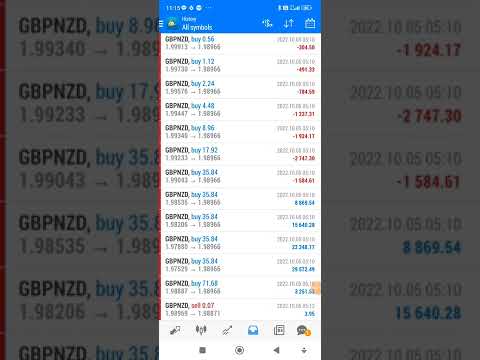

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Visit website for more information.

https://mmfx.vvip-members.com/ Contact us

moneymakerfxea@gmail.com

MoneyMaker FX EA Trading Robot

FOREX NEWS & BLOG

MoneyMaker FX EA Trading Robot님의 실시간 스트림

September 24, 2022 3:49 pm | Uncategorized

Forex EA Trading Robot

https://mmfx.vvip-members.com/ If your account balance is less than US$3,000, open an FBS Cent account via the link below.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en If your account balance is more than US$30,000, open an Tickmill Pro or VIP account via the link below.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA Trading Robot

USD/JPY: Elliott Wave Analysis and Forecast for 06.02.26–13.02.26

February 6, 2026 1:57 pm | FOREX NEWS

Major Takeaways Main scenario: Once the correction ends, consider long positions above 150.80 with a target of 162.00–165.00. A buy signal: the price holds above 150.80. Stop Loss: below 150.80, Take Profit: 162.00–165.00. Alternative scenario: Breakout and consolidation below the level of 150.80 will allow the pair to continue declining to the levels of 147.80–145.40. A sell signal: the level of 150.80 is broken to the downside. Stop Loss: above 150.80, Take Profit: 147.80–145.40. Main Scenario Consider long positions above the level of 150.80 with a target of 162.00–165.00 once the correction ends. Alternative Scenario Breakout and consolidation below 150.80… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

WTI Crude Oil: Elliott Wave Analysis and Forecast for 06.02.26–13.02.26

February 6, 2026 1:24 pm | FOREX NEWS

Major Takeaways Main scenario: Consider short positions from corrections below the level of 66.32 with a target of 50.50–45.00. A sell signal: the price holds below 66.32. Stop Loss: above 66.32, Take Profit: 50.50–45.00. Alternative scenario: Breakout and consolidation above the level of 66.32 will allow the asset to continue rising to the levels of 77.50–84.00. A buy signal: the level of 66.32 is broken to the upside. Stop Loss: below 66.32, Take Profit: 77.50–84.00. Main Scenario Consider short positions from corrections below the level of 66.32 with a target of 50.50–45.00. Alternative Scenario Breakout and consolidation above the level… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

EUR/USD: Elliott Wave Analysis and Forecast for 06.02.26–13.02.26

February 6, 2026 12:59 pm | FOREX NEWS

Major Takeaways Main scenario: Once the correction ends, consider long positions above 1.1575 with a target of 1.2400–1.2750. A buy signal: the price holds above 1.1575. Stop Loss: below 1.1575, Take Profit: 1.2400–1.2750. Alternative scenario: Breakout and consolidation below the level of 1.1575 will allow the asset to continue declining to the levels of 1.1254–1.1040. A sell signal: the level of 1.1575 is broken to the downside. Stop Loss: above 1.1575, Take Profit: 1.1254–1.1040. Main Scenario Consider long positions above the level of 1.1575 with a target of 1.2400–1.2750 once the correction ends. Alternative Scenario Breakout and consolidation below 1.1575… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

GBP/USD: Elliott Wave Analysis and Forecast for 06.02.26–13.02.26

February 6, 2026 12:35 pm | FOREX NEWS

Major Takeaways Main scenario: Once the correction ends, consider long positions above 1.3342 with a target of 1.4050–1.4300. A buy signal: the price holds above 1.3342. Stop Loss: below 1.3342, Take Profit: 1.4050–1.4300. Alternative scenario: Breakout and consolidation below the level of 1.3342 will allow the pair to continue declining to the levels of 1.3000–1.2710. A sell signal: the level of 1.3342 is broken to the downside. Stop Loss: above 1.3342, Take Profit: 1.3000–1.2710. Main Scenario Consider long positions above the level of 1.3342 with a target of 1.4050–1.4300 once the correction ends. Alternative Scenario Breakout and consolidation below 1.3342… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

USD/CHF: Elliott Wave Analysis and Forecast for 06.02.26–13.02.26

February 6, 2026 12:07 pm | FOREX NEWS

Major Takeaways Main scenario: After the correction ends, consider short positions below the level of 0.8040 with a target of 0.7420–0.7200. A sell signal: the price holds below 0.8040. Stop Loss: above 0.8040, Take Profit: 0.7420–0.7200. Alternative scenario: Breakout and consolidation above the level of 0.8040 will allow the pair to continue rising to the levels of 0.8210–0.8400. A buy signal: the level of 0.8040 is broken to the upside. Stop Loss: below 0.8040, Take Profit: 0.8210–0.8400. Main Scenario Consider short positions below the level of 0.8040 with a target of 0.7420–0.7200 once the correction is completed. Alternative Scenario Breakout… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

Silver Follows Smart Money. Forecast as of 06.02.2026

February 6, 2026 11:03 am | FOREX NEWS

The silver bubble has finally burst. This was bound to happen sooner or later, as commodity markets are cyclical. Should we expect XAG/USD to return to its extremes, or will that take decades? Let’s discuss that and outline a trading plan. Major Takeaways The silver market bubble has burst. Hedge funds anticipated this outcome. The uptrend in XAG/USD has been broken. As long as silver trades below $85, selling remains the preferred strategy. Weekly Fundamental Forecast for Silver From hero to zero, it takes just one step. Once hailed as “gold on steroids,” or “gold squared,” silver has now turned… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

forex auto trading robot

February 6, 2026 10:40 am | FOREX NEWS

forex auto trading robot mmfx.vvip-members.com

February 6, 2026 10:40 am | FOREX NEWS

today’s profit fx auto trading robot

February 6, 2026 10:40 am | FOREX NEWS

Short-Term Analysis for Oil, Gold, and EURUSD for 06.02.2026

February 6, 2026 10:36 am | FOREX NEWS

Welcome, my fellow traders! I have prepared a price forecast for the USCrude, XAUUSD, and EURUSD using a combination of the margin zones method and technical analysis. Based on the market analysis, I suggest entry signals for intraday traders. Oil extended its short-term bearish trend yesterday. Major Takeaways USCrude: The oil price has reached the first bearish target of $62.60 and is now rising again. XAUUSD: Gold is climbing within a short-term uptrend after touching the support B 4,772–4,740. EURUSD: The euro is approaching the lower Target Zone 1.1758–1.1725. Oil Price Forecast for Today: USCrude Analysis Oil is trading in a… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

fx auto trading

February 6, 2026 10:10 am | FOREX NEWS

Today’s profit (FBS Real) fx auto trading

February 6, 2026 10:10 am | FOREX NEWS