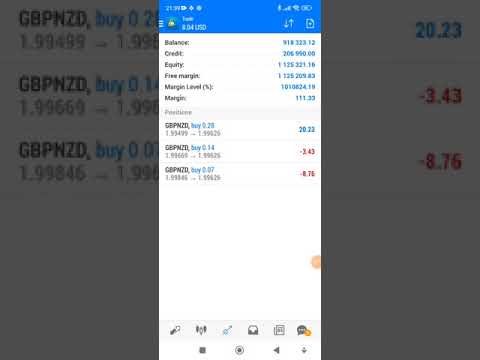

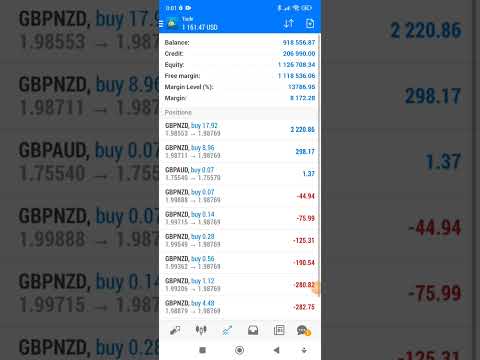

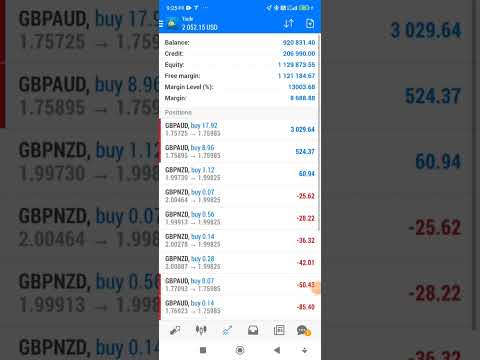

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Visit website for more information.

https://mmfx.vvip-members.com/ Contact us

moneymakerfxea@gmail.com

MoneyMaker FX EA Trading Robot

FOREX NEWS & BLOG

MoneyMaker FX EA Trading Robot님의 실시간 스트림

September 24, 2022 3:49 pm | Uncategorized

Forex EA Trading Robot

https://mmfx.vvip-members.com/ If your account balance is less than US$3,000, open an FBS Cent account via the link below.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en If your account balance is more than US$30,000, open an Tickmill Pro or VIP account via the link below.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA Trading Robot

Escalating Tension in the Middle East Clouds Outlook

July 5, 2025 11:36 pm | FOREX NEWS

Stocks fell and oil prices jumped higher at the end of last week as conflict arose in the Middle East. Read more about that and other news here.

Feed from Admiralmarkets.com

OPEC+ will increase oil output production more than expected: +548,000 (+411,000 expected)

July 5, 2025 5:47 pm | FOREX NEWS

OPEC+ will raise oil production by 548,000 barrels per day in August. This is faster than expected.

- OPEC+ had previously announced increases of 411,000 barrels per day for each month of May, June and July, and this was the increase expected to be announced at Saturday’s meeting.

OPEC+ cited:

- steady global economic outlook

- current healthy market fundamentals, as reflected in the low oil inventories

Oil media reports cite unnamed members of the cartel as saying the group will consider the boosted 548,000 barrels a day for September output once again at the next meeting, scheduled for August 3.

–

The increase in output marks a significant shift from years of supply restraint. The jump in production aligns with a perceived shift in strategy from OPEC+ to market share (US shale drillers took some volumes away from OPEC+ members previously) over price defence.

The background to this is that back in 2023 the group announced 2.2 million bpd in cuts. The 411K boosts to output are unwinding these cuts, the 548K announced Saturday accelerates the unwind.

Notes:

- there is still a further 1.66 million bpd of idle capacity

- despite the official increase, actual output may fall short

This article was written by Eamonn Sheridan at www.forexlive.com.

Feed from Forexlive.com

5 Uncomfortable Truths About Trading

July 5, 2025 4:28 pm | FOREX NEWS

If you feel frustrated over your performance, don’t worry. It may be that you’re forgetting a few basic truths about trading.

Feed from Babypips.com

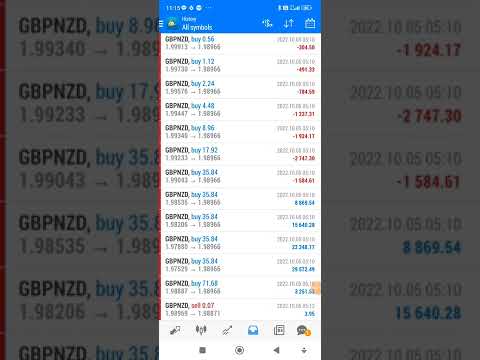

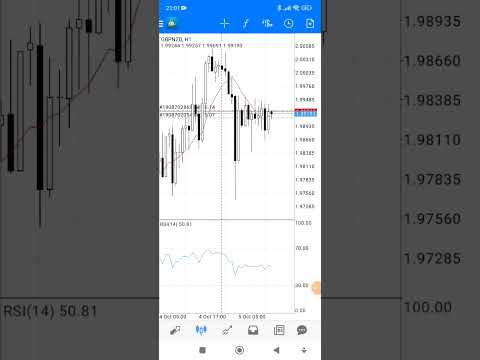

forex auto trading robot

July 5, 2025 3:50 pm | FOREX NEWS

forex auto trading robot mmfx.vvip-members.com

July 5, 2025 3:50 pm | FOREX NEWS

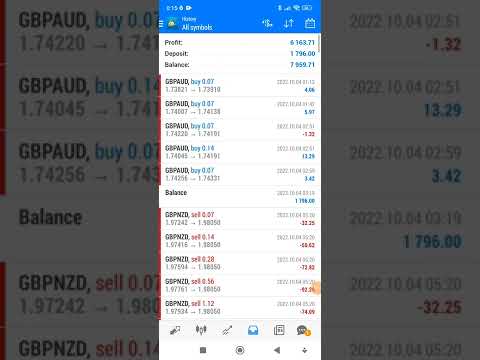

today’s profit fx auto trading robot

July 5, 2025 3:50 pm | FOREX NEWS

USD CAD Forecast for 2025, 2026, 2027–2030 and Beyond

July 5, 2025 3:19 pm | FOREX NEWS

The USDCAD pair is a major currency pair in the Forex market, reflecting the economic health of the United States and Canada, the two largest trading partners. The pair’s fluctuations reflect not only the difference in interest rates and economic indicators of the respective countries, but also the state of the world commodity markets, especially oil, as Canada is a major exporter of energy commodities. This article assesses the key forecasts for the coming years, provides fundamental and technical analysis, and evaluates the impact of global factors on the USDCAD exchange rate. Major Takeaways The current price of the USDCAD… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

USD mixed on trade concerns – Scotiabank

July 5, 2025 3:05 pm | FOREX NEWS

Markets are adopting a risk-off approach ahead of the weekend. The US Dollar (USD) is narrowly mixed against the core majors but the JPY and CHF are outperforming on the day while high beta FX is tending to underperform, Scotiabank’s Chief FX Strategists Shaun Osborne and Eric Theoret report.

Feed from Fxstreet.com

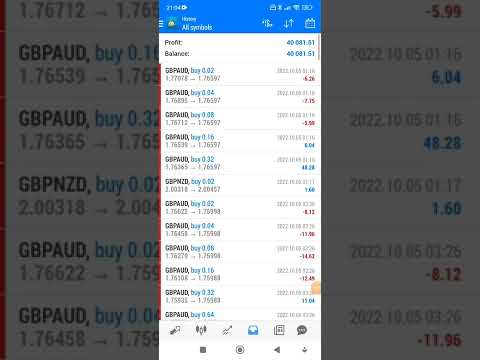

fx auto trading

July 5, 2025 2:50 pm | FOREX NEWS

Today’s profit (FBS Real) fx auto trading

July 5, 2025 2:50 pm | FOREX NEWS

today’s profit (fx trading robot)

July 5, 2025 2:50 pm | FOREX NEWS

today’s profit (tickmill) fx auto trading robot

July 5, 2025 2:50 pm | FOREX NEWS