FOREX NEWS & BLOG

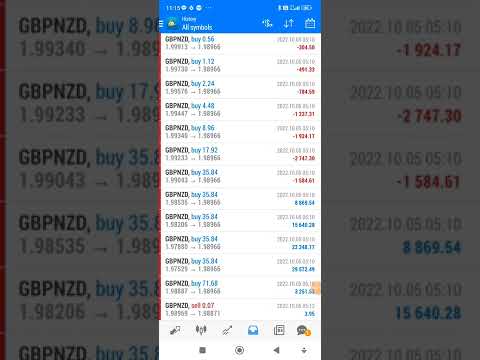

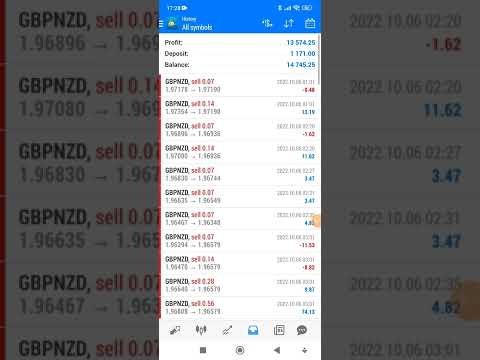

today’s profit (fx trading robot)

July 2, 2025 2:40 pm | FOREX NEWS

today’s profit (tickmill) fx auto trading robot

July 2, 2025 2:40 pm | FOREX NEWS

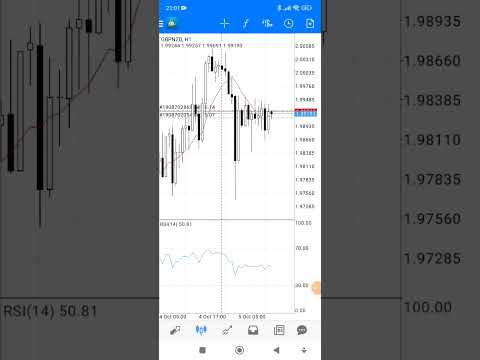

forex auto trading

July 2, 2025 2:40 pm | FOREX NEWS

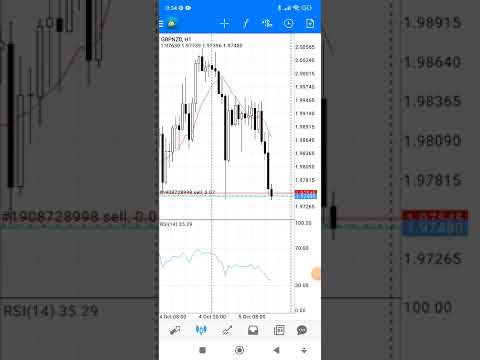

gbp crazy

July 2, 2025 2:40 pm | FOREX NEWS

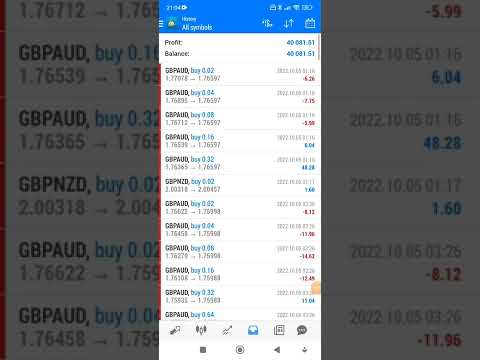

today’s profit FBS Real (fx auto trading robot)

July 2, 2025 2:40 pm | FOREX NEWS

today’s profit (FBS Real account) fx auto trading robot

July 2, 2025 2:40 pm | FOREX NEWS

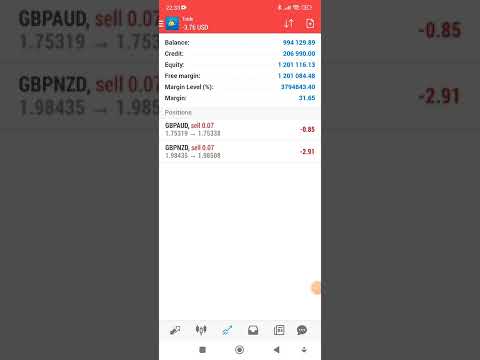

today’s profit (tickmill)

July 2, 2025 2:40 pm | FOREX NEWS

Gold Price Forecast: XAU/USD steadies ahead of Thursday’s Nonfarm Payroll (NFP) report

July 2, 2025 2:26 pm | FOREX NEWS

Gold (XAU/USD) price is trading in a tight range as traders digest Wednesday’s Automatic Data Processing (ADP) employment data and look ahead to Thursday’s Nonfarm Payroll (NFP) report.

Feed from Fxstreet.com

GBP/JPY drops to two-week low below 196.00 on UK political jitters

July 2, 2025 2:24 pm | FOREX NEWS

Pound Sterling stays under heavy selling pressure on Wednesday as markets assess the latest political developments in the UK. At the time of press, GBP/JPY was trading at its lowest level in two weeks near 195.50, losing 0.8% on a daily basis.

Feed from Fxstreet.com

Eyes on the House today as Republicans aim to pass budget bill

July 2, 2025 2:20 pm | FOREX NEWS

We’re into the end game for Trump’s “Big, Beautiful Bill” after the Senate voted to pass it yesterday. Now it’s back into the House and the aim from Republican leaders is to get it passed before July 4.

I think the market has largely priced in a passage, at least of the corporate tax proposals. There are critical things here for healthcare companies and others that benefit from government largess but I don’t see many macro risks that aren’t already priced in. Of course, one day the costs will hit intolerable levels and there will have to be some real austerity.

US 10-year yields are up 4.9 bps to 4.30% and are well-within recent ranges.

It’s obvious to me that AI will be crippling for government finances as unemployment rises and demands for government help rise. That will then spiral back towards the AI winners — corporations — who will be asked to pay more via taxes.

This article was written by Adam Button at www.forexlive.com.

Feed from Forexlive.com

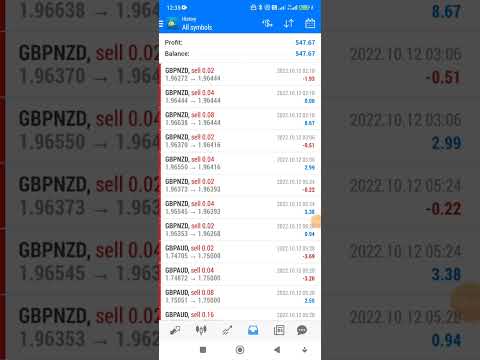

Today’s profit(FBS Cent account Real) 1=0.01usd

July 2, 2025 2:10 pm | FOREX NEWS