FOREX NEWS & BLOG

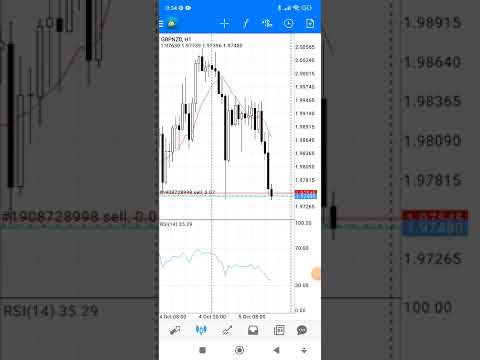

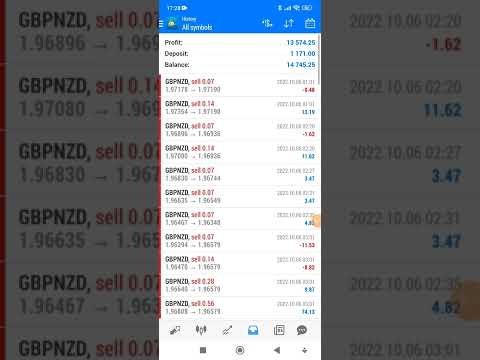

today’s profit FBS Real (fx auto trading robot)

February 6, 2026 10:10 am | FOREX NEWS

today’s profit (FBS Real account) fx auto trading robot

February 6, 2026 10:10 am | FOREX NEWS

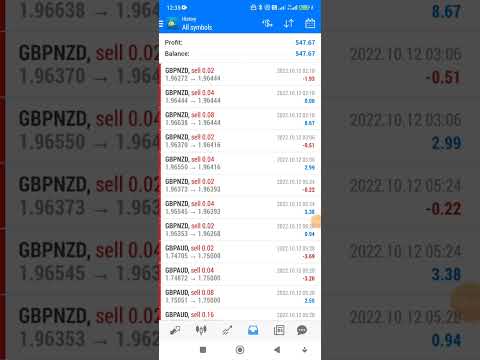

today’s profit (tickmill)

February 6, 2026 10:10 am | FOREX NEWS

Today’s profit(FBS Cent account Real) 1=0.01usd

February 6, 2026 10:10 am | FOREX NEWS

Forex Today: US Dollar corrects lower ahead of consumer sentiment data

February 6, 2026 9:59 am | FOREX NEWS

Here is what you need to know on Friday, February 6:

Feed from Fxstreet.com

MT5 ADX Indicator

February 6, 2026 9:13 am | FOREX NEWS

The MT5 ADX indicator cuts through this noise by measuring one thing: trend strength. It doesn’t care about direction—up or down doesn’t matter. What it tells you is whether the current move has conviction or if you’re better off sitting on your hands. That single piece of information can save traders from countless bad entries […]

Feed from Forexmt4indicators.com

Gold: Price outlook remains uncertain – Commerzbank

February 6, 2026 8:35 am | FOREX NEWS

Commerzbank’s report by Dr. Jörg Krämer and Bernd Weidensteiner discusses the recent fluctuations in Gold prices, highlighting a partial recovery from a slump.

Feed from Fxstreet.com

AUD/CAD rises above 0.9500 ahead of Canada’s labor market data

February 6, 2026 8:35 am | FOREX NEWS

AUD/CAD remains in the positive territory after recovering its daily losses, trading around 0.9520 during the European hours on Friday. However, the upside of the currency cross could be limited as the commodity-linked Canadian Dollar (CAD) receives support from higher Oil prices.

Feed from Fxstreet.com

Short-Term Analysis for BTCUSD, XRPUSD, and ETHUSD for 06.02.2026

February 6, 2026 8:00 am | FOREX NEWS

Dear readers, I’ve prepared a short-term forecast for Bitcoin, Ripple, and Ethereum based on the Elliott Wave analysis. Major Takeaways BTCUSD: Wave (Z) continues to develop. The price may decline to 60,736.28. Consider short positions. XRPUSD: The price continues to decline in the ending diagonal wave. Consider short positions with Take Profit at 1.063. ETHUSD: Bearish wave Z continues to develop. Consider opening short positions targeting 1,694.49. Elliott Wave Analysis for Bitcoin Bitcoin is likely forming the second half of a bullish impulse [1]-[2]-[3]-[4]-[5]. On the H4 chart, the impulse wave [3] has been completed, and the price is now declining in… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

Chart Art: NZD/CAD’s Trend Retracement Opportunity Near 1.8100

February 6, 2026 7:40 am | FOREX NEWS

NZD/CAD is heading for a key area of interest! Is the pair CAD starting a reversal? Or are we looking at a pullback opportunity in the making?

Feed from Babypips.com

US Dollar Firms As ECB Stands Pat. Forecast as of 06.02.2026

February 6, 2026 7:27 am | FOREX NEWS

On Forex, turbulence gives way to lulls and vice versa. Volatility rises and falls, and Donald Trump has a hand in this. His hands-off approach allows investors to focus on monetary policy again. Let’s discuss this topic and make a trading plan for the EUR/USD pair. Major Takeaways The European Central Bank did no harm to the euro. The US labor market is raising concerns. The dollar exchange rate depends on volatility. Selling the EUR/USD pair on the upswing to 1.1835 is relevant. Weekly US Dollar Fundamental Forecast Christine Lagarde’s statement that the ECB cannot be held hostage by a… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com