FOREX NEWS & BLOG

today’s profit (tickmill)

February 3, 2026 10:02 am | FOREX NEWS

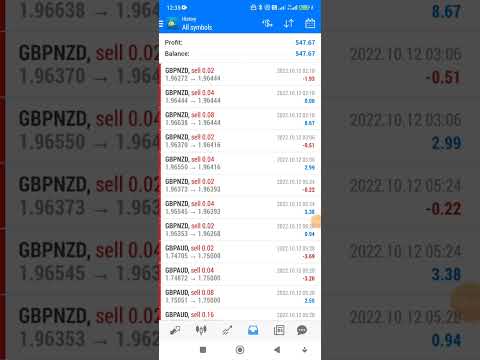

Today’s profit(FBS Cent account Real) 1=0.01usd

February 3, 2026 10:02 am | FOREX NEWS

3 Tips to Help You Stay “In the Zone” While Trading

May 11, 2024 5:56 pm |

Being “in the zone” comes down to how well you can maintain focus and pure concentration. Here are some tips on how you can apply this in forex trading.

Feed from Babypips.com

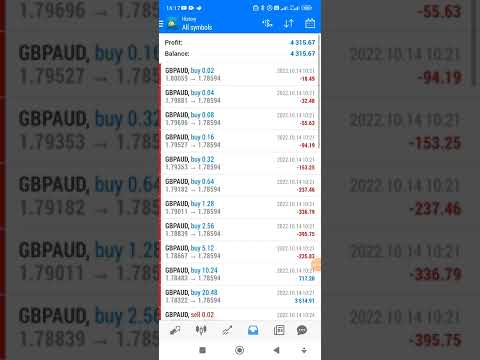

Today’s profit : fx auto trading robot (Tickmill)

February 27, 2023 2:34 am |

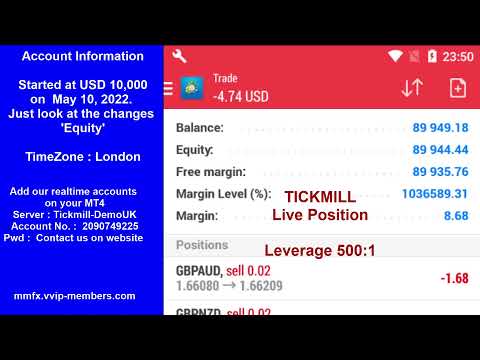

MoneyMaker FX EA Trading Robot

September 24, 2022 3:49 pm | Uncategorized

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Visit website for more information.

https://mmfx.vvip-members.com/ Contact us

moneymakerfxea@gmail.com

MoneyMaker FX EA Trading Robot

MoneyMaker FX EA Trading Robot님의 실시간 스트림

September 24, 2022 3:49 pm | Uncategorized

Forex EA Trading Robot

https://mmfx.vvip-members.com/ If your account balance is less than US$3,000, open an FBS Cent account via the link below.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en If your account balance is more than US$30,000, open an Tickmill Pro or VIP account via the link below.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA Trading Robot