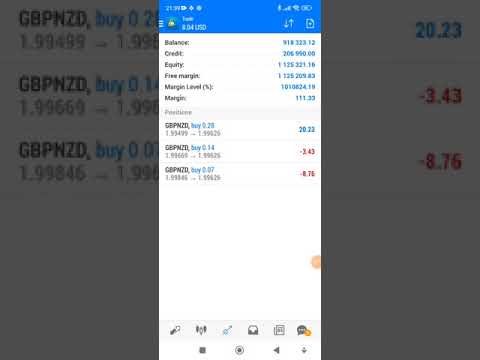

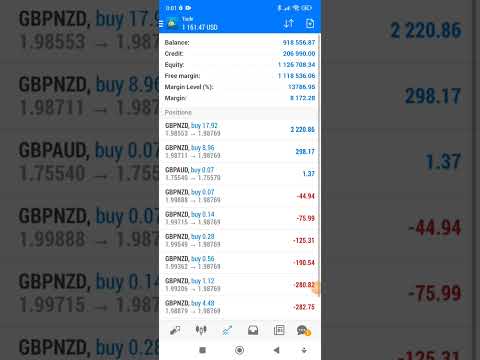

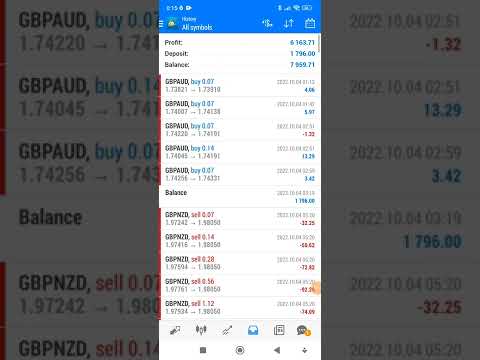

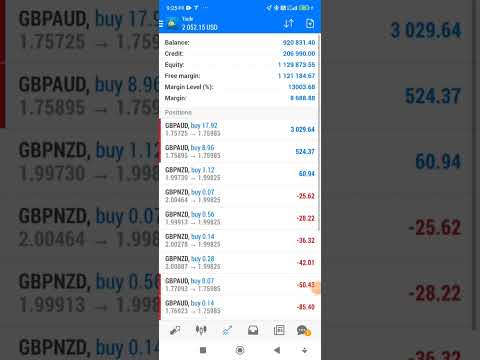

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Visit website for more information.

https://mmfx.vvip-members.com/ Contact us

moneymakerfxea@gmail.com

MoneyMaker FX EA Trading Robot

FOREX NEWS & BLOG

MoneyMaker FX EA Trading Robot님의 실시간 스트림

September 24, 2022 3:49 pm | Uncategorized

Forex EA Trading Robot

https://mmfx.vvip-members.com/ If your account balance is less than US$3,000, open an FBS Cent account via the link below.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en If your account balance is more than US$30,000, open an Tickmill Pro or VIP account via the link below.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA Trading Robot

Vaulta (EOS) Forecast: AUSD (EOSUSD) Price Prediction for 2026, 2027, 2028–2030 and Beyond

March 5, 2026 5:10 pm | FOREX NEWS

Vaulta (formerly EOS) is a blockchain platform designed to facilitate the development of decentralized applications (dApps) and smart contracts. The project’s primary objective is to address the challenges of scalability, transaction speed, and high transaction fees. Launched in 2018 by Block.one, Vaulta garnered significant attention with its successful initial coin offering (ICO), during which the creators managed to raise over $4 billion. The platform employs the Delegated Proof-of-Stake (DPoS) blockchain consensus mechanism, facilitating substantially faster transactions and higher network bandwidth. Vaulta maintains its position in the blockchain industry, attracting developers and investors worldwide. This article examines forecasts of the AUSD… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

What Is a Stock Index and How Does It Work?

March 5, 2026 4:34 pm | FOREX NEWS

A stock index is not just a number on a screen. It is a key indicator that reflects the condition of a specific market segment or an entire national stock exchange. Through a stock market index, financial analysts can quickly assess overall market sentiment without reviewing dozens or even hundreds of companies individually. Today, the global stock market includes numerous market indexes, each built using its own index calculation methodology and designed for a specific purpose. Some indices reflect the state of the economy as a whole, while others focus on a particular market sector or industry. Understanding what a… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

Bitcoin Price Forecast & Predictions for 2026, 2027, 2028–2030, and Beyond

March 5, 2026 4:31 pm | FOREX NEWS

Bitcoin is the world’s first and most popular cryptocurrency. The token dominates the cryptocurrency market, shaping the entire digital asset industry. Its decentralized nature and limited supply of 21 million coins make it unique, ensuring long-term demand among traders and investors. This article examines the current fundamental factors that have influenced Bitcoin’s growth, its history of creation, and reviews expert forecasts and in-depth technical analysis. Major Takeaways The current BTC price is $71 387.02 as of 05.03.2026. The BTC price reached its all-time high of $126073.42 on 06.10.2025. The cryptocurrency hit its all-time low of $4.2 on 18.02.2012. Forecasts reflect high… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

forex auto trading robot

March 5, 2026 2:50 pm | FOREX NEWS

forex auto trading robot mmfx.vvip-members.com

March 5, 2026 2:50 pm | FOREX NEWS

today’s profit fx auto trading robot

March 5, 2026 2:50 pm | FOREX NEWS

USD/INR: Oil spike keeps Rupee pressured – Commerzbank

March 5, 2026 2:39 pm | FOREX NEWS

Commerzbank’s Charlie Lay highlights that the Indian Rupee has weakened as global Oil prices surge, pushing USD/INR above 92.00 for the first time.

Feed from Fxstreet.com

MT4 Time Zone Indicator

March 5, 2026 2:21 pm | FOREX NEWS

The MT4 Time Zone Indicator solves this problem by overlaying vertical lines on your chart that mark when major trading sessions begin and end. Instead of guessing whether you’re trading during Tokyo’s lunch break or New York’s opening rush, you’ll know exactly which session you’re in—and whether conditions favor your strategy. What the MT4 Time […]

Feed from Forexmt4indicators.com

ECB Accounts: Governing Council confident in inflation outlook despite uncertainty

March 5, 2026 2:17 pm | FOREX NEWS

The publication of the Accounts of the European Central Bank’s (ECB) February monetary policy meeting highlights the Governing Council’s relative confidence regarding inflation trends, while emphasising that the environment remains marked by uncertainty.

Feed from Fxstreet.com

What is Fundamental Analysis in Forex Trading?

March 5, 2026 2:16 pm | FOREX NEWS

Fundamental analysis is an approach that primarily examines economic and political indicators of a country, an industry, or a specific company. Unlike technical analysis, it does not focus on charts or price patterns. The goal of a fundamental analyst is to identify cause-and-effect relationships and compare the current market price of an asset with its intrinsic value. In this article, we explain the fundamental analysis definition, review the main methods used in fundamental analysis in forex, and discuss how economic indicators affect currency prices. Major Takeaways Fundamental analysis is a market analysis method in which an investor looks for the… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

US Payrolls: Labor stabilization supports Fed hold – TD Securities

March 5, 2026 2:02 pm | FOREX NEWS

TD Securities economists expect February Nonfarm Payrolls (NFP) to slow to 60k, with 70k private jobs and a 10k decline in government employment.

Feed from Fxstreet.com

fx auto trading

March 5, 2026 1:51 pm | FOREX NEWS