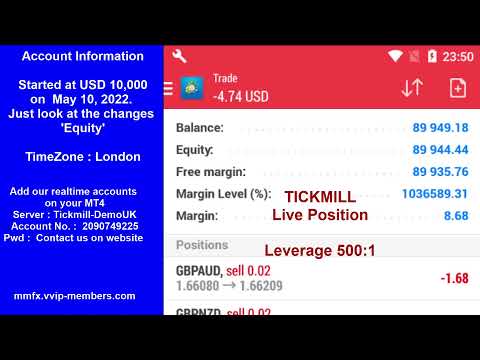

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Visit website for more information.

https://mmfx.vvip-members.com/ Contact us

moneymakerfxea@gmail.com

MoneyMaker FX EA Trading Robot

FOREX NEWS & BLOG

MoneyMaker FX EA Trading Robot님의 실시간 스트림

September 24, 2022 3:49 pm | Uncategorized

Forex EA Trading Robot

https://mmfx.vvip-members.com/ If your account balance is less than US$3,000, open an FBS Cent account via the link below.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en If your account balance is more than US$30,000, open an Tickmill Pro or VIP account via the link below.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA Trading Robot

Trump Signs GENIUS Act Into Law, Setting Stage for Wider Crypto Oversight

July 18, 2025 10:22 pm | FOREX NEWS

President Donald Trump signed the Guiding and

Establishing National Innovation for U.S. Stablecoins (GENIUS) Act into law on

Friday, marking the United States’ first formal step toward regulating digital

assets.

The legislation focuses on defining and overseeing

stablecoin issuers and is seen as a foundation for broader crypto regulation

efforts.

The bill passed the House with a 308-122 bipartisan

majority and cleared the Senate earlier with a 68-30 vote. Senior Republicans and several top executives from the crypto sector attended Friday’s signing ceremony at the White House.

Industry Moves From Lobbying to Compliance

With the GENIUS Act now law, implementation

responsibilities shift to federal financial and banking regulators. These

agencies will define which entities qualify to issue stablecoins, a market

currently led by firms such as Tether and Circle, though Wall Street

institutions have shown growing interest.

TRUMP: 🇺🇸 “The Golden Age of America is upon us, with today’s signing.”President Trumps signs the Genius Act signaling the first of Stablecoin legislation. pic.twitter.com/JD2TtV0p9b

— CoinDesk (@CoinDesk) July 18, 2025

While enforcement details remain to be written, the

law provides a first outline for how the U.S. government plans to treat

dollar-pegged digital assets. Analysts expect that implementation will take

time, potentially extending into the next administration.

The White House event reportedly featured a notable roster of

crypto industry leaders. Among those in attendance were Kraken co-CEO David

Ripley, Gemini co-founders Cameron and Tyler Winklevoss, Coinbase CEO Brian

Armstrong, Circle CEO Jeremy Allaire, Tether CEO Paolo Ardoino, and Robinhood

CEO Vladimir Tenev.

Read more: US House Paves the GENIUS Act’s Way for Regulating Stablecoins

Vice President JD Vance and House Speaker Mike Johnson reportedly also attended the ceremony, signaling political commitment from the top of the

Republican leadership. Trump acknowledged the presence and support of the

crypto figures during the event.

“By moving from regulation through enforcement to

clear rules, the US will strengthen its place as a global leader in

cryptocurrencies and may encourage other countries to follow,” said Yuval Rooz,

CEO and co-founder of Digital Asset.

Addressing Stablecoins

The GENIUS Act addresses only stablecoins,

leaving much of the broader crypto ecosystem, including exchanges and other

tokenized assets, outside its scope. However, the bill is expected to serve as

a policy model for future legislation targeting the wider crypto industry.

For the digital asset sector, the focus now turns to

how regulators will translate the law’s framework into enforceable rules. The

GENIUS Act marks a beginning, not an end, to U.S. crypto policymaking.

This article was written by Jared Kirui at www.financemagnates.com.

Feed from Financemagnates.com

Forexlive Americas FX news wrap 18 Jul:The USD closes higher vs major currencies this week

July 18, 2025 10:22 pm | FOREX NEWS

- NASDAQ closes the day higher and closes at record levels each day this week

- What key events the releases are scheduled for next week’s trading?

- California Gov. Newson proposes to ease permits for oil drilling in California

- Fed’s Goolsbee: Need some resolution on tariffs ot understand impact on inflation

- Trump signs GENIUS Act (Guiding and Establishing National Innovation for Stablecoins)

- What earnings are on the calendar for next week?

- Baker Hughes oil rig count -2 to 422

- FT: Trump is pushing for 15 – 20% minimum tariff on all EU goods. EURUSD moves lower.

- Major European indices are closing mixed to end the week

- Fed Goolsbee: A little wary as latest CPI shows tariffs pushing up goods inflation

- IMF: Since April, economic indicators reflect a complex backdrop shaped by trade tension

- University of Michigan sentiment (preliminary) for July 61.8 versus 61.5 estimate

- Atlanta Fed GDPNow growth estimate for Q2 remains unchanged at 2.4%

- If the Fed were to cut rates to 1% as Trump demands, long term rates would actually rise

- US housing starts 1.321M vs 1.300M estimate

- Fed’s Waller: If the president asked me to do the Fed chair job, I’d say yes

- Fed’s Waller: Private sector is not doing as well as it seems

- US Bessent on Japan: A trade deal remains in the ‘realm of possibility’

- ForexLive European FX news wrap: Dollar gets a case of the Waller hangover

- Trump continues to lambast “too late” Powell

U.S. Treasury Secretary Scott Bessent said a trade deal with Japan remains in the “realm of possibility,” but emphasized that securing a good deal is more important than rushing one. He indicated that negotiations are ongoing and that the outcome of Japan’s upcoming election could be pivotal to reaching an agreement. Hope springs eternal, but Japan was insulted by the tariff letter.

Also on tariffs, the Financial Times reported that President Trump is pushing for a 15–20% minimum tariff on all EU goods, down from the previously floated 30% in “the letter.” He also refuses to reduce the existing 25% tariff on EU cars and is considering a reciprocal tariff exceeding 10%, even if a deal is reached. Trump has rejected a zero-tariff framework, insisting that access to the U.S. market should carry a baseline tax, effectively between 10% and 20%, while keeping U.S. exports tariff-free. The EURUSD moved lower on the headlines, and the EU trade commissioner reportedly gave a downbeat readout of recent Washington talks. What we can say is the markets are becoming comfortable (the Nasdaq and S&P traded at new records), but with August 1st approaching, the rubber will meet the road soon and the impact on inflation, stocks, bonds and FX could heat up.

The USD is closing next/mostly lower. Looking at the greenback’s change versus the major currencies:

- EUR -0.26%

- JPY +0.09%

- GBP +0.06%

- CHF -0.41%

- CAD -0.16%

- AUD -0.31%

- NZD -0.49%

For the trading week, despite the decline versus most currencies today, the USD was higher vs all the major currencies as concerns about lower growth overseas and higher inflation supported the greenback:

- EUR +0.52%

- JPY +0.915

- GBP +0.55%

- CHF +0.66%

- CAD +0.33%

- AUD +1.00%

- NZD +0.71%

The Fed will go into quiet mode over the next week and a half until the rate decision on July 30. Today, Fed’s Goolsbee and Waller spoke. Waller was quite emphatic on Thursday evening sayinng he still supports a 25bps rate cut in July, citing rising downside risks and weakening labor market conditions. He stressed that the Fed should not wait for job losses to act, warning that delayed easing could require more aggressive cuts later. Waller sees GDP growth near 1% and believes policy should move closer to neutral.

He noted that private hiring is near stall speed, and the labor market is “on the edge.” While tariffs may raise inflation 0.75–1% in the short term, he views them as a temporary shock, with core inflation close to 2% absent the tariff effects. A July cut would give the Fed space to pause for a few meetings, he said.

Waller also said there’s uncertainty around the neutral Fed funds rate, and 3% may still reflect loose conditions. He confirmed no contact with the Trump team about a potential Fed Chair role. On QT, he sees limited interest in selling MBS and expects the balance sheet runoff to remain slow. He also said stablecoins are not a threat but introduce useful competition in payments. Lastly, he emphasized that data should guide the pace of future cuts, and there’s “nothing wrong with an insurance cut.”

Fed’s Goolsbee sounded like he might want to cut but was dissuaded by the uncertainty on inflation from tariffs. Goolsbee expressed caution ahead of the Fed’s blackout period, noting that the latest CPI data shows tariffs are pushing up goods inflation. He emphasized the need for clarity on the scope and timeline of tariffs, warning that the current “drip-drip” rollout prevents treating them as a one-time price shock. Goolsbee also stated that uncertainty around inflation and trade policy could delay rate cuts, though he acknowledged that it’s realistic for rates to move lower over the next year if conditions stabilize. He added that more months of consistent inflation data would make him more confident in cutting rates and voiced concern over challenges to central bank independence.

Looking at the US debt market, yields are closing mixed for the week with the threat that Chairman Powell would be fired causing volatility and a shift higher in the yield curve. The 2-year yield is closing the week down -2.2 basis points, while the 30 year bond is closing the week six basis points.

Looking at the closing levels:

- 2-year yield 3.871%, -4.6 basis points. For the week yields are down -2.2 basis points after being up as much as 7 basis points.

- 5-year yield 3.948, -5.8 basis points. For the week, yields are down -3.2 basis points after being up as much as 7.4 basis points.

- 10-year yield 4.419%, -4.3 basis points. For the week, the yield is up 0.3 basis points after being up as high as 7.8 basis points.

- 30-year yield 4.990%, -2.3 basis points. For the week, yield is up 3.6 basis points after being up as much as 12.1 basis points

Next week will be a key week for earnings with Tesla and Alphabet, leading the releases. Below is a list of the major releases before and after market close:

-

Monday 7/21 – Before Open: Verizon (VZ), Domino’s Pizza (DPZ),

-

Monday 7/21 – After Close: NXP Semiconductors (NXPI)

-

Tuesday 7/22 – Before Open: Lockheed Martin (LMT), Coca‑Cola (KO), Philip Morris (PM), General Motors (GM), D.R. Horton (DHI), Northrop Grumman

-

Tuesday 7/22 – After Close: Texas Instruments (TXN), SAP (SE), Intuitive Surgical (ISRG), Capital One (COF)

-

Wednesday 7/23 – Before Open: AT&T (T), GE Vernova (GEV), Freeport‑McMoRan (FCX), AT&T, General Dynamics

-

Wednesday 7/23 – After Close: Tesla (TSLA), Alphabet (GOOGL), ServiceNow (NOW), IBM (IBM), Chipotle (CMG)

-

Thursday 7/24 – Before Open: American Airlines (AAL), Nokia (NOK), Dow (DOW), Southwest (LUV), Honeywell (HON)

-

Thursday 7/24 – After Close: Intel (INTC)

-

Friday 7/25 – Before Open: Centene (CNC)

On the economic calendar, the ECB rate decision will be the highlight. The central bank is expected to keep rates unchanged. Other than that, regional flash PMI indices will be released.

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

EUR/USD drops below 1.1600 as US Dollar strengthens on robust Retail Sales data

July 18, 2025 9:15 pm | FOREX NEWS

The Euro (EUR) extended its decline against the US Dollar on Thursday, weighed down by a stronger Greenback and upbeat US economic data.

Feed from Fxstreet.com

What key events the releases are scheduled for next week’s trading?

July 18, 2025 8:30 pm | FOREX NEWS

Next week, the Fed will be in the quiet period ahead of the FOMC rate meeting on July 30.

The S&P Global flash manufacturing and services data will be released for Europe and the US on Thursday. The ECB will likely keep rates unchanged, but given the tariff threat, will likely be biased to more easing (although they are also near neutral rates now).

US initial jobless claims fell to 221K last week and moved back toward the lower levels after a modest rise toward 250K.

Below is the scheduled of released.

Sunday, July 20

6:45pm ET – NZD CPI q/q – Forecast: 0.6% Previous: 0.9%

All day – JPY Upper House Elections

Wednesday, July 23

11:05am ET – AUD RBA Gov Bullock Speaks

Thursday, July 24

3:15am ET – EUR French Flash Manufacturing PMI – Forecast: 48.5 Previous: 48.1

3:15am ET – EUR French Flash Services PMI – Forecast: 49.7 Previous: 49.6

3:30am ET – EUR German Flash Manufacturing PMI – Forecast: 49.4 Previous: 49.0

3:30am ET – EUR German Flash Services PMI – Forecast: 50.0 Previous: 49.7

4:30am ET – GBP Flash Manufacturing PMI – Forecast: 48.1 Previous: 47.7

4:30am ET – GBP Flash Services PMI – Forecast: 52.9 Previous: 52.8

8:15am ET – ECB Rate Decision: EUR Main Refinancing Rate – Forecast: 2.15% Previous: 2.15%

8:15am ET – EUR ECB Monetary Policy Statement

8:30am ET – USD Unemployment Claims – Forecast: 229K Previous: 221K

8:45am ET – EUR ECB Press Conference

9:45am ET – USD Flash Manufacturing PMI – Forecast: 52.7 Previous: 52.9

9:45am ET – USD Flash Services PMI – Forecast: 53.0 Previous: 52.9

Friday, July 25

2:00am ET – GBP Retail Sales m/m – Forecast: 1.2% Previous: -2.7%

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

Fed’s Kugler: It is appropriate to keep rates steady “for some time”

July 18, 2025 8:03 pm | FOREX NEWS

FOMC Governor Adriana Kugler said that the Federal Reserve should not lower interest rates “for some time” since the effects of Trump administration tariffs are starting to show up in consumer prices. She added that restrictive monetary policy is essential to keep inflationary psychology under line.

Feed from Fxstreet.com

Are stocks still forming a top?

July 18, 2025 8:02 pm | FOREX NEWS

The S&P 500 continues to consolidate – what’s next? Stocks pulled back on Wednesday as some profit-taking occurred, but the S&P 500 index still closed 0.32% higher, further extending its short-term consolidation.

Feed from Fxstreet.com

Elliott Wave analysis: SPY poised to extend higher in bullish sequence [Video]

July 18, 2025 7:36 pm | FOREX NEWS

Elliott Wave sequence in SPY (S&P 500 ETF) suggest bullish sequence in progress started from 4.07.2025 low. It expects two or few more highs to extend the impulse sequence from April-2025, while dips remain above 6.23.2025 low.

Feed from Fxstreet.com

Major European indices are closing mixed to end the week

July 18, 2025 7:14 pm | FOREX NEWS

The major European indices are ending the week with mixed results:

- German DAX, -0.35%

- France’s CAC, +0.01%

- UK’s FTSE 100 +0.22%

- Spain’s Ibex -0.04%

- Italy’s FTSE MIB +0.46%.

For the trading week,:

- German DAX +0.14%

- France’s CAC -0.08%

- UK’s FTSE 100 +0.57%

- Spain’s Ibex, -0.14%

- Italy’s FTSE MIB, +0.58%

Next week will have the clock ticking to the August 1 deadline for tariffs. Tariff levels are set to rise to 30%. Even if they have some agreement, I would think that 10% would probably be the absolute best, and that would come with no tariffs from the EU. The tariff level might still be higher than that.

Trump is loving collecting tariff money, and seems to be putting eggs in the basket that other inflation will come down

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

Bovespa Index Elliott Wave technical analysis [Video]

July 18, 2025 7:09 pm | FOREX NEWS

Function: Bullish Trend. Mode: Impulsive. Structure: Gray Wave 3.

Feed from Fxstreet.com

Gold recovers as focus shifts to US consumer sentiment data

July 18, 2025 7:05 pm | FOREX NEWS

Gold (XAU/USD) is trading higher on Friday as investors remain focused on Fed expectations and look ahead to key US economic data. At the time of writing, XAU/USD recovers above $3,350, pushing the price closer toward the upper boundary of a symmetrical triangle pattern.

Feed from Fxstreet.com

FT: Trump is pushing for 15 – 20% minimum tariff on all EU goods. EURUSD moves lower.

July 18, 2025 6:43 pm | FOREX NEWS

The FT is now reporting that Pres. Trump is pushing for a 15 – 20% minimum tariff on all EU goods. The tariff rate as set by “the letter” had pinned the rate at 30%.

- He also rejects reducing the 25% sectorial duty on EU cars.

- The administration is also looking at a reciprocal tariff rate that exceeds 10%, even if a deal is reached.

- EU trade Commissioner gave a downbeat assessment of his recent talks in Washington to EU ambassadors on Friday

As mentioned, Trump is not interested in 0% tariffs. He has alluded that there is a tax for having access to the US (rightly or wrongly). That tax is 10% to 20% WITH no tariffs on US exports (have your cake and eat it too).

He will cite national security as his power to invoke. He also sees tariffs as a way to claw back.

EU companies would not be tariffs on goods manufactured and sold in the US.

Like it or don’t like it, it is what he is doing.

The EURUSD has moved lower to test the 100-hour MA. That came after the test of the 200 hour MA and swing area between 1.1663 and 1.1691 stalled the rally (see earlier post here outlining the key barometer for buyers and sellers).

A move below the 100-hour MA would have the low of another swing area at 1.1614 and then will look toward 1.1563 – 1.1578 followed by the 38.2% retracement of the move up from the May low. That level comes in at 1.15372.

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

US stock indices dip to the downside after Trump 15 – 20% push for EU tariffs

July 18, 2025 6:23 pm | FOREX NEWS

After the Financial Times reported that Pres. Trump is pushing for a 15 – 20% tariff on all the EU goods and looks to keep 25% tariff on autos, the US stocks have tilted to the downside.

- Dow industrial average -0.55%

- S&P index -0.18%

- NASDAQ index 0.16%

- Russell 2000-0.64%

Both the S&P and the NASDAQ closed at record levels yesterday. For the trading week:

- Dow industrial average -0.30%

- S&P +0.43%

- NASDAQ index +1.30%

- Russell 2000+0.19%

Looking at the US debt market, yields are still lower on the day with the two-year yield down the most:

- 2-year yield 3.862%, -5.44 basis points

- 5-year yield 3.946%, -5.9 basis points

- 10 year yield 4.419%, -4.3 basis points

- 30 year yield 4.990%, -2.3 basis points

for the trading week, yields are lower:

- 2-year yield -3.0 basis points

- 5-year yield -3.2 basis points

- 10 year yield unchanged

- 30 year yield +3.5 basis points

The Fed funds interest rate is pricing in less than 50 basis points of cuts between now and the end of the year.

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

![Elliott Wave analysis: SPY poised to extend higher in bullish sequence [Video]](https://i0.wp.com/mmfx.vvip-members.com/wp-content/uploads/2025/07/elliott-wave-analysis-spy-poised-to-extend-higher-in-bullish-sequence-video.jpg?resize=400%2C250&ssl=1)

![Bovespa Index Elliott Wave technical analysis [Video]](https://i0.wp.com/mmfx.vvip-members.com/wp-content/uploads/2025/07/bovespa-index-elliott-wave-technical-analysis-video.png?resize=400%2C250&ssl=1)