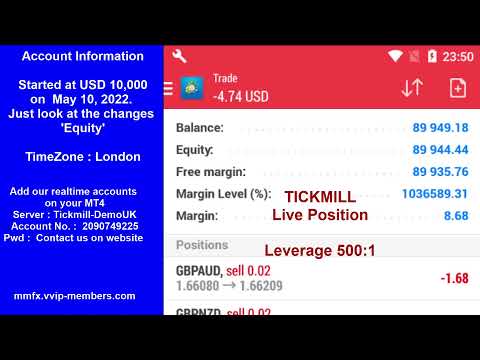

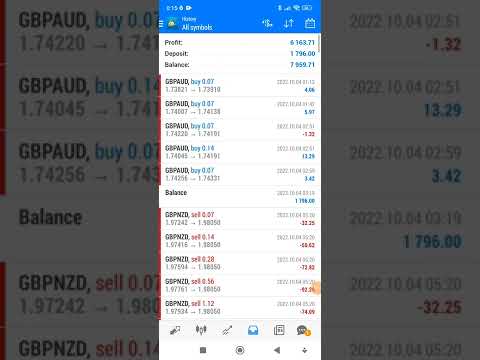

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Visit website for more information.

https://mmfx.vvip-members.com/ Contact us

moneymakerfxea@gmail.com

MoneyMaker FX EA Trading Robot

FOREX NEWS & BLOG

MoneyMaker FX EA Trading Robot님의 실시간 스트림

September 24, 2022 3:49 pm | Uncategorized

Forex EA Trading Robot

https://mmfx.vvip-members.com/ If your account balance is less than US$3,000, open an FBS Cent account via the link below.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en If your account balance is more than US$30,000, open an Tickmill Pro or VIP account via the link below.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA Trading Robot

Silver Price Forecast: XAG/USD steadies after three-day decline

July 11, 2025 5:25 pm | FOREX NEWS

Silver (XAG/USD) is holding firm on Thursday after a strong start to the day, recovering from a three-day losing streak as market sentiment turns cautious once again.

Feed from Fxstreet.com

Market movers today: Nvidia soars while Meta stumbles amidst sector volatility

July 11, 2025 5:24 pm | FOREX NEWS

Sector Overview

The US stock market today presents a dynamic landscape with varied performances across sectors, as depicted in the heatmap. Notably, the semiconductor sector shines bright, led by Nvidia (NVDA) with a substantial rise of 2.04%, contrasting with the general downtick in the technology sector.

- Semiconductors: Nvidia’s surge highlights renewed optimism in semiconductors, likely driven by advancements in AI technologies and strong demand forecasts.

- Communication Services: In stark contrast, Meta (META) plunged by 1.51%, reflecting investor concerns possibly linked to regulatory challenges or market saturation.

- Financial Sector: Exhibits significant pressure with banks like JPMorgan Chase (JPM) and Bank of America (BAC) down by 0.98% and 1.17% respectively, indicating sector-wide uncertainties.

- Industrials: A refreshing spot as General Electric (GE) emerges with a 1.29% rise, signaling robust industrial output or favorable economic indicators.

Market Mood and Trends

The overall market sentiment appears mixed with a cautious tilt, attributed mainly to sector-specific dynamics and external economic pressures. While technology, especially semiconductors, displays bullish tendencies, areas like communication services and financials struggle with bearish sentiment.

Investors seem reactive to ongoing global economic discussions and corporate earnings potential, which are central to shaping today’s market mood. Meta’s struggles denote possible challenges in sustaining growth amidst competitive pressures.

Strategic Recommendations

Given the current market conditions, here’s what investors might consider:

- Diversify Portfolio: Spread risk across sectors, especially adding defensive stocks amidst volatility in technology and finance.

- Focus on Tech Advancements: Leverage Nvidia’s thriving momentum for gains in AI-driven innovations, keeping an eye on announcements that could impact stock movements.

- Monitor Financials Closely: Anticipate further fluctuations due to economic policies affecting bank performances, advising caution or strategic entry points.

- Observe Sector-specific News: Align investments with developments in industrial growth, which hold potential for long-term stability as evidenced by GE’s performance.

Stay informed with real-time updates on ForexLive.com for actionable insights and analyses to navigate the unfolding market scenarios effectively.

This article was written by Itai Levitan at www.forexlive.com.

Feed from Forexlive.com

Cautious trading ahead – S&P 500 faces global headwinds and policy divergence

July 11, 2025 5:05 pm | FOREX NEWS

The E-mini S&P 500 is trading cautiously amid rising global tensions and domestic economic uncertainty.

Feed from Fxstreet.com

USDJPY moves above the 38.2% of the move down from the 2025 trading range

July 11, 2025 5:00 pm | FOREX NEWS

The USDJPY has moved above the 38.2% retracement of the 2025 trading range, measured from the January 10 high to the April 22 low. That retracement level comes in at 147.135, and it’s aligned with a key swing area between 147.014 and 147.338. The pair has extended to a high of 147.515, marking the third attempt to break and hold above this level since the April low.

Previous moves above the 38.2% retracement—on May 12 and June 23—ultimately failed to hold, but this renewed push gives buyers another opportunity to seize control. From a technical perspective, staying above 147.135 is now critical. If that support holds, upside targets include the June high at 148.019, followed by the May high at 148.647, which sits within a notable swing area between 148.56 and 148.724 (highlighted by red circles on the chart). That swing area increases the May highs importance

The market is once again testing the waters for a bullish breakout. The question now is: Will buyers finally maintain momentum above the 38.2% retracement, or will this be another failed attempt? The close risk level for USD bulls is clear—hold above 147.135 to keep the bullish case alive.

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

Brazil’s Lula: If US tariffs take effect, we will reciprocate

July 11, 2025 4:39 pm | FOREX NEWS

- W will fight for US tariffs not to take effect

- Trump is misinformed, the US does not run a trade deficit with Brazil

One of Brazil’s main exports to the US is coffee so there is no advantage to the US placing tariffs on it. The Brazilian real is barely down since the whole thing blew up, which tells you the market’s view of it.

This article was written by Adam Button at www.forexlive.com.

Feed from Forexlive.com

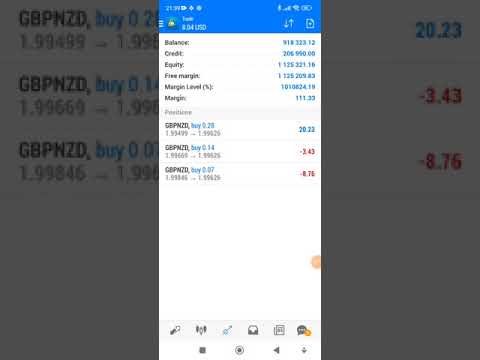

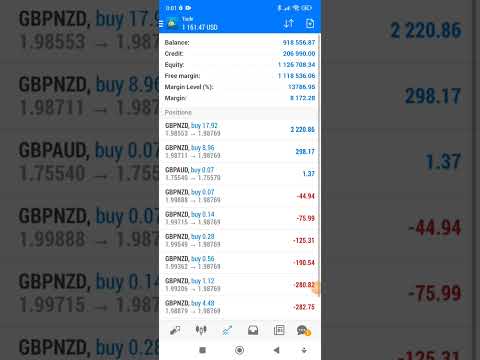

forex auto trading robot

July 11, 2025 4:30 pm | FOREX NEWS

forex auto trading robot mmfx.vvip-members.com

July 11, 2025 4:30 pm | FOREX NEWS

today’s profit fx auto trading robot

July 11, 2025 4:30 pm | FOREX NEWS

MultiBank’s MEX Orient CEO Exits, Launches Institutional Finance Platform Fuchase

July 11, 2025 4:06 pm | FOREX NEWS

Niki Saki has stepped down as Chief Executive Officer of MEX

Orient. She shared the update in a LinkedIn post today (Friday), confirming the end of her

involvement with the project. Saki served as Chief Executive Officer of MEX

Orient for six months, based in Dubai.

MEX Orient was launched by MultiBank

Group to expand into underdeveloped markets, focusing on Central Asia, the

Middle East, and North Africa. The unit was led by Saki and

aimed to manage region-specific operations.

Fuchase Targets Brokers, Investors Globally

In the announcement, she thanked the MultiBank team for

their trust and collaboration but did not elaborate on the reasons for her

departure.

Now a former CEO of MEX Orient, Saki plans to focus on new

initiatives. She introduced one of them, a platform called Fuchase, describing

it as “a specialized marketplace designed for institutional financial

organizations, providing a platform where they can connect with Tier 1 and Tier

2 liquidity providers, fintech firms, banks, hedge funds, and wealth management

companies.”

The platform will offer structured solutions and expert

advisory services to help organizations explore, compare, and select offers

suited to their needs.

Saki said Fuchase will serve Introducing Brokers, Forex

brokers, and investors, offering access to advanced tools for financial

operations. She added that the platform aims to support the performance and

growth of financial institutions globally. Details of a second project are

expected in the coming months.

MultiBank, MAG Partner for Asset Tokenization

Meanwhile, MultiBank

has partnered with Dubai-based MAG and blockchain firm Mavryk in a $3

billion agreement to tokenize real estate assets. The initiative, led through

MultiBank.io, involves bringing high-value properties onto the blockchain.

MultiBank.io is operated by MEX Digital FZE, which recently

obtained a Virtual Asset Service Provider license from Dubai’s VARA. The

license allows certain virtual asset activities and supports the platform’s

infrastructure. A utility token, $MBG, will be used for access and transactions

within the digital investment ecosystem.

This article was written by Tareq Sikder at www.financemagnates.com.

Feed from Financemagnates.com

Yen Remains Depressed As US Tariff Letters Land. Forecast as of 08.07.2025

July 11, 2025 3:50 pm | FOREX NEWS

Tokyo’s request for a reduction in the tariffs imposed by Washington has led to tensions between the two nations. Donald Trump threatened to raise tariffs to 35% but ultimately limited them to 25%. As a result, the USDJPY pair surged. Let’s discuss this topic and make a trading plan. Major Takeaways Japan has been hit with higher tariffs from the US. Parliamentary elections are putting pressure on the yen. Tokyo should show flexibility in negotiations. Long trades on the USDJPY pair can be considered if the price pierces 146.5. Weekly Fundamental Forecast for Yen The markets are constantly evolving, and… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

GBPUSD moved down to swing area on the weekly chart.

July 11, 2025 3:35 pm | FOREX NEWS

The GBPUSD has been steadily moving lower in today’s trading. The decline has been fueled by weaker UK economic data and a broader wave of US dollar strength, as markets respond to the inflationary implications of higher U.S. tariffs. Additionally, rising concerns over slower global growth have supported safe-haven flows into the dollar, adding further pressure to the pound.

Looking at the weekly chart, the USDCAD has dipped into a key swing area dating back to 2016, which spans between 1.3411 and 1.3514. Today’s low reached 1.3495, with a modest bounce currently taking the pair to around 1.3504.

On the hourly chart below, the price decline today has broken below the 61.8% retracement level at 1.3529, moving further away from the 100-hour moving average (blue line). While the pair briefly moved above that moving average yesterday, it quickly reversed lower with momentum, signaling strong selling pressure.

The pair also fell through a swing area between 1.3505 and 1.3514, reaching a session low of 1.3495. These broken levels now act as near-term resistance, and traders will be watching them closely. A move back above 1.3514, and especially the 61.8% level at 1.3529, would be a disappointment for sellers. That retracement level has been tested multiple times this week — including lows on Tuesday and yesterday — and today’s break adds to its technical significance going forward.

That 61.8% area the key area now and going forward. Stay below and more momentum to the downside can be anticipated. Move above and the technicals tilt more to the upside at least in short-term.

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

EUR/USD: Elliott Wave Analysis and Forecast for 11.07.25 – 18.07.25

July 11, 2025 3:35 pm | FOREX NEWS

Major Takeaways Main scenario: Once the correction ends, consider long positions above the level of 1.1450 with a target of 1.2050 – 1.2400. A buy signal: the price holds above 1.1450. Stop Loss: below 1.1400, Take Profit: 1.2050 – 1.2400. Alternative scenario: Breakout and consolidation below the level of 1.1450 will allow the pair to continue declining to the levels of 1.1210 – 1.1060. A sell signal: the level of 1.1450 is broken to the downside. Stop Loss: above 1.1500, Take Profit: 1.1210 – 1.1060. Main Scenario Consider long positions above the level of 1.1450 with a target of 1.2050… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com