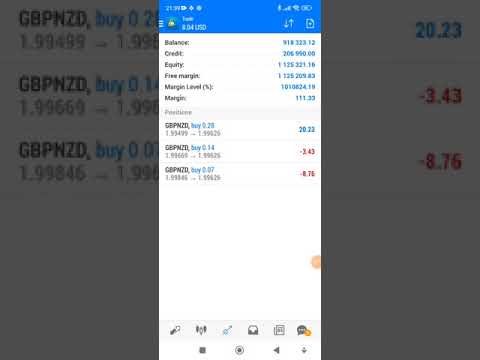

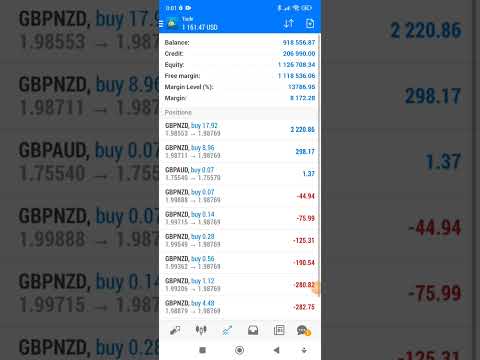

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Visit website for more information.

https://mmfx.vvip-members.com/ Contact us

moneymakerfxea@gmail.com

MoneyMaker FX EA Trading Robot

FOREX NEWS & BLOG

MoneyMaker FX EA Trading Robot님의 실시간 스트림

September 24, 2022 3:49 pm | Uncategorized

Forex EA Trading Robot

https://mmfx.vvip-members.com/ If your account balance is less than US$3,000, open an FBS Cent account via the link below.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en If your account balance is more than US$30,000, open an Tickmill Pro or VIP account via the link below.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA Trading Robot

Bailey speech: Our commitment to 2% inflation target is unwavering

May 9, 2025 10:00 am | FOREX NEWS

Bank of England Governor Andrew Bailey reiterated on Friday that their commitment to the 2% inflation target is unwavering, per Reuters.

Feed from Fxstreet.com

Pound Sterling flattens against US Dollar as investors await US-China trade talks

May 9, 2025 9:51 am | FOREX NEWS

The Pound Sterling (GBP) recovers some intraday losses and flattens around 1.3250 against the US Dollar (USD) in European trading hours on Friday. The GBP/USD pair attracts bids as the US Dollar corrects slightly after a strong upside on Thursday.

Feed from Fxstreet.com

European equities open higher to start the final day of the week

May 9, 2025 9:43 am | FOREX NEWS

- Eurostoxx +0.4%

- Germany DAX +0.6%

- France CAC 40 +0.6%

- UK FTSE +0.4%

- Spain IBEX flat

- Italy FTSE MIB +0.6%

US futures are also keeping steadier, with S&P 500 futures seen up 0.1%. The US-UK trade deal agreement yesterday helped to steady the ship but it was mostly comments from Trump that caused markets to rally. His mentions of “better go out and buy stocks now” and “the stock market will really rally now” were what got the animal spirits pumped up.

This article was written by Justin Low at www.forexlive.com.

Feed from Forexlive.com

SNB’s Price Stability Goal: A Return to Negative Interest Rates?

May 9, 2025 9:35 am | FOREX NEWS

With the strong franc pushing Swiss inflation to its weakest point in over four years, raising concerns about the Swiss National Bank’s ability to maintain its price stability mandate around the 2% level that underpins economic growth, the focus now shifts to: What policy actions are financial markets anticipating from the SNB in this context? and What impact is this scenario having, and expected to have, on the dynamics of Forex trading involving the Swiss Franc?

A Tradition of Stability: Switzerland’s Low Inflation Even Amid Global Shocks

Switzerland has a well-established history of subdued inflation. The country even managed to keep its inflation rates significantly below those of the US and the EU, when energy prices spiked dramatically after Russia invaded Ukraine.

The Swiss National Bank itself projects an average inflation rate of just 0.4% for the current year. However, the latest inflation data paints an even weaker picture than anticipated – a situation that doesn’t fit the price stability mandate of the SNB.

Headline Inflation Hits Four-Year Low at 0%

Consumer prices stagnated in April compared to the previous year, falling sharply from 0.3% in March to 0%. This significant deceleration undershot most forecasts and inflation reached its lowest level in more than 4 years.

Core Inflation Decelerates More Than Anticipated

Core inflation, which excludes volatile items, also saw a more pronounced slowdown than expected, registering at +0.6% year-on-year (down from April 2024) and a mere +0.1% compared to the previous month (March 2025).

HICP Confirms Subdued Inflationary Pressures

Even the Swiss Harmonised Index of Consumer Prices (HICP), designed for international comparison, showed a modest increase of +0.7% month-on-month but only +0.3% year-on-year, further highlighting the prevailing low inflationary environment.

Why Did Inflation Hit 0% in April in Switzerland?

Switzerland’s inflation reaching 0% in April is no coincidence. At the heart of this price stability is the ongoing strength of the Swiss franc (CHF), which has played a key role in keeping the cost of living in check—especially when compared to other economies in Europe or the United States.

The Power of a Strong Currency

The Swiss franc has been gaining value steadily, particularly in recent years. In April 2025, it reached a record high against the US dollar and continued to strengthen against the euro—up nearly 10% against the dollar this year alone. This means that Swiss consumers and businesses can buy foreign goods and services more cheaply, because their currency holds more purchasing power.

In simple terms: when the Swiss franc gets stronger, the price Switzerland pays for imported products—like food, fuel, and manufactured goods—goes down. This directly reduces inflation, since many of the everyday products consumed in Switzerland come from abroad.

A Historical Perspective About the Strength of the Swiss Franc

The Swiss franc has long been considered a “safe haven” currency. In times of global uncertainty—like economic crises, trade tensions, or political instability—investors tend to buy Swiss francs to protect their money. This demand drives up the franc’s value.

This isn’t new. Back in 2008 during the global financial crisis, and again during the euro crisis in 2011, investors flocked to the franc. The Swiss National Bank (SNB) even had to step in to stop the franc from getting too strong by introducing a cap against the euro. When they removed that cap in 2015, the franc spiked again. Since then, the SNB has followed a policy of occasional, discreet interventions in the currency markets to manage the franc’s value without clearly defined limits.

Despite these efforts, the franc has continued to rise, especially in politically unstable times, such as during recent announcements from former President Donald Trump that shook global markets again.

How a Strong Franc Holds Down Inflation

The effect of a rising Swiss franc on inflation is simple.

Imagine a product from the Eurozone that costs €100. If the franc strengthens by 10% against the euro, that same product effectively becomes 10% cheaper in Switzerland. Since many consumer goods in Switzerland are imported, his appreciation significantly lowers overall prices.

This isn’t just a theoretical impact. Over time, a strong franc has repeatedly helped Switzerland avoid the high inflation that has plagued other countries. By making imported goods cheaper, it offsets rising domestic costs and keeps inflation low or even at zero, as seen in April.

The Bigger Picture: Stability, Confidence, and Economic Strength

Switzerland’s political neutrality and strong institutions also boost confidence in its currency. In today’s world, where geopolitical tensions and trade uncertainties are common, investors trust the Swiss franc as a stable store of value. This adds consistent demand for the currency and reinforces its strength.

The benefit isn’t just price stability.

A strong currency, lower inflation, and stable interest rates also create favorable conditions for the Swiss economy as a whole. Exporters may face some challenges when selling goods abroad—because Swiss-made products become more expensive for foreign buyers—but overall, the low inflation helps sustain purchasing power at home, supports employment, and keeps the economy running smoothly, which tends to attract investors.

Will the SNB Implement Negative Interest Rates Again?

After five consecutive rate cuts—bringing its key interest rate down from 1.75% in March 2024 to just 0.25%—markets are now betting that the SNB will lower rates to 0% at its next policy meeting on June 19. Some economists even believe a return to negative interest rates is on the table—a possibility confirmed by SNB Chairman Martin Schlegel himself.

SNB Prepared to Deploy FX Tools and Negative Rates for Price Stability

He recently acknowledged rising concerns about low inflation and strong Swiss Franc, as well as volatile markets and geopolitical risks, stating that the central bank is prepared to take further action to keep inflation aligned with its price stability mandate. This includes both foreign exchange interventions to weaken the franc and, if necessary, a new negative interest rates era.

Although the bank may intervene in the currency markets, such actions carry the risk of being seen as currency manipulation, particularly by the U.S., potentially worsening trade tensions.

Anticipation of Further Easing Grows in Bond Market

Yields on short-term Swiss government bonds have fallen back into negative territory—with two-year yields dropping to -0.18%, a level not seen in over two years. Securities with maturities up to 5 years are now trading below 0%, signaling that investors are bracing for rates to stay low—or go lower—for some time.

One More Inflation Report Might Hold Key to SNB’s Next Move

While June may be too soon for a move back into negative territory, given that the SNB will have only one more inflation report before then, the direction of the next appears to be clear. If the Swiss franc continues to climb and inflation remains flat or negative, the SNB could be forced to act more aggressively in the second half of the year.

This article was written by FM Contributors at www.financemagnates.com.

Feed from Financemagnates.com

New CFD Broker Versus Trade Launches with Unique ‘Asset-vs-Asset’ Product Offering

May 9, 2025 9:30 am | FOREX NEWS

Amid rising volatility across global financial markets — from gold reaching historic highs of $3,500 per ounce (up 31% since January, according to IG) to tech stocks swinging in response to geopolitical uncertainty and macroeconomic signals — interest in dynamic and narrative-driven trading instruments is surging. Analysts attribute the gold rally to a mix of central bank accumulation (with China importing over 700 metric tons), inflationary pressures, and a weakening dollar, with some projections suggesting a potential climb toward $4,000 per ounce.

Versus Trade enters this environment with a unique approach — offering “Versus Pairs,” proprietary CFD instruments that allow retail traders to speculate on how one asset performs against another. Rather than taking isolated long or short positions, users can now express market opinions in a comparative format, whether it’s crypto vs. commodities or old economy vs. innovation.

As of May 2025, Versus Trade steps onto the scene — a platform developed by traders, for traders, with a clear focus on the fast-growing Asian markets — including Malaysia, Thailand, Indonesia, and Vietnam.

Innovative Asset-vs-Asset CFDs for Strategic Traders

The key distinction of Versus Trade lies in its focus on gamified, head-to-head asset comparisons — turning traditional CFD trading into an engaging experience built around rivalry, contrast, and strategic alignment. Instead of simply trading Gold or Bitcoin, traders can now position themselves in the narrative of digital assets versus traditional stores of value, or explore macro themes like West versus East, innovation versus legacy, and growth versus stability.

At the core of the platform are unique trading pairs such as:

● Bitcoin vs Gold – digital gold versus the traditional safe-haven asset

● Amazon vs Alibaba – Western versus Eastern dominance in global e-commerce

● Tesla vs Ford – the electric future versus legacy automotive manufacturing

These matchups are more than just tickers — they are stories. And beyond flagship combinations like Bitcoin vs Gold or Amazon vs Alibaba, Versus Trade offers a broader lineup of asset-vs-asset instruments covering commodities, indices, and thematic sectors — allowing traders to engage with cross-market dynamics and relative performance.

This model resonates with a new generation of retail traders — those who are accustomed to trading on leverage, reacting to news flow, and seeking out high-volatility opportunities. For them, Versus Trade delivers both engagement and strategic optionality in a format that reflects how modern traders think and act.

Built by Traders, Tailored for the Modern Asian Market

Versus Trade was founded by professional trader Vitaliy Bulynin, who designed the platform based on real-world trading experience. The platform is not built around promotional gimmicks or corporate marketing goals, but around functional features that support practical execution.

According to Bulynin, the Versus Trade CFD trading platform is designed to move beyond traditional chart-based approaches by enabling modern traders to engage in comparative trading strategies grounded in market conviction and relative asset performance.

This is not just trading — it’s storytelling, choosing sides, strategy, and community.

“Trading is not just about charts. It’s about beliefs, analysis, and the spirit of competition. We want to make it exciting and intelligent at the same time,” says Versus Trade CEO Vitaliy Bulynin.

Positioning and Outlook

With its regulated CFD infrastructure, trader-centric design, and a distinctive portfolio of multi-asset, asset-vs-asset instruments, Versus Trade is positioned as a modern alternative to traditional online brokers. Combining product innovation with market localization, the platform aims to reshape retail trading in high-growth regions through transparency, usability, and strategic differentiation.

On the technology side, Versus Trade integrates with MetaTrader 5, offering full support for algorithmic trading, multi-asset execution, and analytical tools for both manual and automated strategies. This positions the platform to serve a wide spectrum of users — from beginner traders to seasoned strategists and signal providers.

By focusing on market relevance, strategic flexibility, and platform reliability, Versus Trade aims to deliver value to both individual traders and institutional partners. In a market crowded with feature-heavy but insight-light offerings, it introduces a trading experience built on clarity, comparison, and conviction.

Learn more at www.versus.trade

This article was written by FM Contributors at www.financemagnates.com.

Feed from Financemagnates.com

Chart Art: WTI Crude Oil (USOIL) Double Bottom Pattern Above $55

May 9, 2025 9:15 am | FOREX NEWS

U.S. crude oil prices bounced higher after hitting $55.00. Will the Black Crack find enough momentum to bust through the closest resistance zone?

Feed from Babypips.com

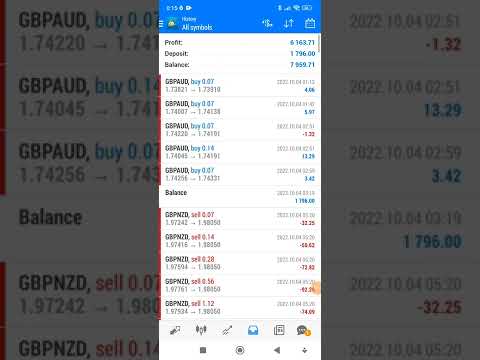

forex auto trading robot

May 9, 2025 9:10 am | FOREX NEWS

forex auto trading robot mmfx.vvip-members.com

May 9, 2025 9:10 am | FOREX NEWS

today’s profit fx auto trading robot

May 9, 2025 9:10 am | FOREX NEWS

The Dollar Will Save the Penalty. Forecast as of 06.05.2025

May 9, 2025 9:01 am | FOREX NEWS

Despite U.S. stock indices falling due to renewed White House tariff threats, EUR/USD bears are staying in the fight. They’re counting on Fed support to restore confidence in the dollar. Let’s discuss it and make a trading plan. Major Takeaways The Fed plans to keep the rate at 4.5%. Odds of resuming monetary expansion in June are fading. The central bank is choosing between recession and stagflation. Buying EUR/USD on a breakout above $1.1355 remains relevant. Weekly Fundamental Forecast for Dollar The truth always comes out. No matter how much the White House hides its aggressive stance, Donald Trump’s 100%… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

USDJPY Technical Analysis – Waller’s scenario #2 is playing out. Now what?

May 9, 2025 8:44 am | FOREX NEWS

Fundamental

Overview

The USD got a boost across

the board yesterday on positive expectations about the first trade deal that

eventually was revealed to be with the UK. Trump announced

that tariffs on cars and steel will be lowered but the most important part was

that the 10% “global tariff” will remain in place.

The US officials

highlighted that the 10% is going to be the floor and the trade deal with the

UK is going to be the baseline for all other deals. There’s a risk now that we

reached the peak in de-escalation and other countries might not like the 10%

floor, especially the EU. For now, the Federal Reserve Governor Waller’s scenario

#2 is playing out.

Recall, that he said 10% or

lower tariffs would make him less inclined to cut rates faster. This is now triggering

a repricing in interest rates as the market scaled back the easing expectations

to 68 bps by year-end. We were at more than 80 bps at the start of the week. It

gave also the greenback a boost as the market unwound the crowded dollar

shorts.

On the JPY side, the

currency has been driven mainly by global events rather than domestic

fundamentals. Alongside the Swiss Franc, it’s been the favoured safe haven in

the currencies space amid the swings in risk sentiment. On the monetary policy

front, the BoJ kept interest rates unchanged as expected and

delivered a dovish message.

This was then echoed by BoJ

Governor Ueda which placed a great deal on trade developments. In summary, the

central bank is likely to go faster on rate hikes in case we get a good trade

deal and delay rate adjustments in case the trade deal disappoints.

USDJPY

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that USDJPY continues to erase the April losses and it’s now approaching

the major trendline. The sellers will likely lean on the trendline with a defined risk above it to

position for a drop back into the 140.00 handle, while the buyers will look for

a break higher to increase the bullish bets into the 151.00 handle next.

USDJPY Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that we have now an upward trendline defining the bullish structure on this

timeframe. From a risk management perspective, the buyers will have a better

risk to reward setup around the trendline, while the sellers will look for a

break lower to increase the bearish bets into new lows.

USDJPY Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we have a minor upward trendline defining the bullish momentum on this

timeframe. The buyers will likely continue to lean on the trendline to keep pushing

into new highs, while the sellers will look for a break lower to extend the

pullback into the next trendline. The red lines define the average daily range for today.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Feed from Forexlive.com

We might have reached the peak in the de-escalation trade

May 9, 2025 8:44 am | FOREX NEWS

If this trade deal with the UK was announced two or three weeks ago, I would have said that it’s really good for the markets and would have been very upbeat on risk sentiment. The context is a bit different now, in my opinion.

Recall back in the middle of April, Fed’s Waller outlined his strategy to deal with tariffs. He had two scenarios in mind: tariffs around 25% on average and tariffs around 10%. The second scenario is the one that is playing out and it involves the Fed being less inclined to cut rates faster.

In fact, the market is taking this first trade deal as the more hawkish scenario for the Fed and the pricing is converging towards the original Fed’s baseline of two rate cuts in 2025 (the pricing is now showing 68 bps by year-end compared to 80 bps at the start of the week).

The problem here is that with new information throughout the weeks, the 10% has become a “meh” outcome. After April 9 pause, the market rallied on expectations that eventually the US would have gone for 10% reciprocal tariffs and would have lowered the tariffs on China back to the original 50-60% rate. This is what the whole “de-escalation trade” was based on.

We have now reached the peak in this trade because the US said that the 10% will be the floor for all other deals and we got a report from New York Post yesterday saying that the US is considering lowering the tariffs on China to 50-54%. Recall, the market was expecting 10% global tariffs and 50% on China before the April 2 surprise.

All of this should now be priced in and the market’s reaction to the news of the US lowering tariffs on China could be a hint. In fact, you would have expected a strong rally, but the market actually went in the opposite way. Nonetheless, this has opened up for a weekend risk scenario in which the market opens up with a positive gap next week, so the selling pressure into the weekend could be limited (I mean it doesn’t look good from a risk management perspective for the bears).

So, what makes this first trade deal a “meh” outcome is that not only we have some overstretched positioning but we also have the risk of retaliation now. The EU has been repeating that they won’t accept the 10% tariff rate and has been threatening a retaliation in case negotiations fail. But the US is saying that 10% is the best anyone can get and tariffs could be even higher.

Next week will be the tell. If we open up with a positive gap and the stock market then performs badly throughout the week, then it could be a signal that we have indeed reached the peak (at least in the short term). I would expect the bears to seize the opportunity and start selling at the start of the week. You either catch the top or you get it wrong, but from a risk/reward perspective it doesn’t look bad at all.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Feed from Forexlive.com