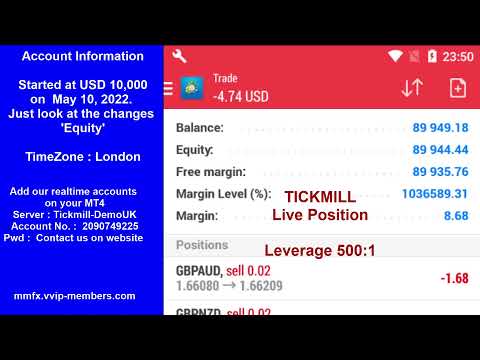

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Visit website for more information.

https://mmfx.vvip-members.com/ Contact us

moneymakerfxea@gmail.com

MoneyMaker FX EA Trading Robot

FOREX NEWS & BLOG

MoneyMaker FX EA Trading Robot님의 실시간 스트림

September 24, 2022 3:49 pm | Uncategorized

Forex EA Trading Robot

https://mmfx.vvip-members.com/ If your account balance is less than US$3,000, open an FBS Cent account via the link below.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en If your account balance is more than US$30,000, open an Tickmill Pro or VIP account via the link below.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA Trading Robot

EUR/USD extends its recovery as hopes of a US – EU deal remain alive

July 14, 2025 9:23 pm | FOREX NEWS

The EUR/USD pair bounced up from lows in the early European session on Monday, and is trading higher for the first time in the past four trading days.

Feed from Fxstreet.com

USD/INR trades firmly as inflation in India cools down again

July 14, 2025 9:17 pm | FOREX NEWS

The Indian Rupee (INR) declines against the US Dollar (USD) at the start of the week, sending the USD/INR pair higher to near 86.15.

Feed from Fxstreet.com

Crude oil futures settle at $66.98

July 14, 2025 9:01 pm | FOREX NEWS

The price of crude oil futures is settling the day at $66.98. That’s down $1.47 or -2.15%.

The price last week traded above and below its 200 day moving average on four of the five trading days, but it was only until Friday that the price closed above that moving average.

In trading today, the price extended to a new high going back to June 24 reaching a peak of $69.61. But momentum reversed and after falling back below the 200-day moving average at $68.33, selling intensified with the price moving down to a low of $66.87 near the end of day.

Looking at the hourly chart above, the price has also fallen below its 100-hour moving average at $67.97, and its 200-hour moving average at $67.37 respectively. Those are also bearish developments.

So, cracking below the 200-day moving average, the 100 hour moving average, and the 200-hour moving average, gives the sellers some needed control, and puts the buyers on the back foot once again.

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

AUDUSD under pressure as key support levels come into view

July 14, 2025 8:41 pm | FOREX NEWS

After last week’s rally in the AUDUSD stalled at an old upward sloping trend line resistance, the pair has come under renewed selling pressure to start the week.Today’s price action is reinforcing the bearish shift, with the pair moving further below the trend line and now eyeing key downside support levels.

Initial focus is on the 100-bar (blue line) and 200-bar (green line) moving averages on the 4-hour chart, currently at 0.6533 and 0.6511, respectively (and both rising). A break and hold below these levels would be an important step toward a deeper decline. Absent that, buyers still retain some control, even as price softens from the highs.

Adding to the technical importance, the 100-bar MA also aligns with the low of a swing area between 0.6535 and 0.6556 (see red circles and yellow shaded zone). This area represents a key decision point for the market.

Below that, the next major target is 0.65096, which marks the 38.2% retracement of the move up from the June low. A break below would likely accelerate bearish momentum, exposing the 50% midpoint and last week’s low near 0.64823 (a dual support target for sellers).

Although the AUDUSD pair is lower over recent sessions, sellers still have work to do to take control from the buyers. A move below both the swing area low at 0.6535 and the rising 100-bar MA at 0.6533 would shift the bias more firmly into bearish territory, giving sellers increased control. Absent that, and the sellers are not winning

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

Economic calendar in Asia 15 July 2025 – China Q2 GDP and June economic activity data

July 14, 2025 8:38 pm | FOREX NEWS

Plenty of data on the way from China today.

Expectations for Q2 GDP are running ahead of the government target:

Expectations for June month data are more mixed, steady for IP and Investment while retail sales are expected to drop back to a still healthy 5.6% y/y growth rate.

Equites in China are being underpinned by flows based on bets of improvement:

- Where are Sovereign Wealth Funds and Central Banks shifting funds to? China, USD

- Chinese President Xi Jinping’s war on deflation speeds up – “Anti – involution” policy

- ICYMI – China set to ramp up and broaden its fiscal support in the second half of the year

- This snapshot from the ForexLive economic data calendar, access it here.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

This article was written by Eamonn Sheridan at www.forexlive.com.

Feed from Forexlive.com

Gold Price Forecast: XAU/USD refreshes three-week high, aims to revisit $3,400

July 14, 2025 8:22 pm | FOREX NEWS

Gold price (XAU/USD) posts a fresh three-week high around $3,370 during the European trading session on Monday.

Feed from Fxstreet.com

Trade ideas thread – Tuesday, 15 July, insightful charts, technical analysis, ideas

July 14, 2025 8:22 pm | FOREX NEWS

Good morning, afternoon and evening all. Any charts, technical analysis, trade ideas, thoughts, views, ForexLive traders would like to share and discuss with fellow ForexLive traders, please do so:

This article was written by Eamonn Sheridan at www.forexlive.com.

Feed from Forexlive.com

XRP Nears $3: Grayscale Challenges SEC Over Paused Multi-Crypto ETF

July 14, 2025 8:14 pm | FOREX NEWS

As major cryptocurrencies, including Bitcoin and XRP, post

gains today, Grayscale Investments has filed a legal challenge against the U.S.

Securities and Exchange Commission after the regulator paused approval of its

Digital Large Cap Fund.

The fund, which includes Bitcoin, Ethereum, XRP, Solana, and

Cardano, was initially approved by the SEC’s Division of Trading and Markets

but was later stayed pending an internal review.

XRP Nears Psychological $3 Level

XRP has approached the key psychological level of $3.

According to the H1 XRP/USD chart, the asset opened the day at 1.54350 and

began moving upward from the second hour of trading. Bullish momentum increased

following a breakout above 2.60000.

After a brief pullback, a bullish engulfing candle pushed

the price to 2.980000. As of writing, the price faced strong resistance at the

day’s high. However, current price action suggests another test of the $3 level

may be likely.

Analysts See XRP Retesting $3.40

Market analysts have identified a

symmetrical triangle pattern in XRP’s monthly chart, indicating a possible

breakout. The current consolidation phase has lasted over 330 days, and some

chart watchers suggest a move could occur between July and mid-September, based

on typical pattern resolution timelines.

With recent price momentum, some analysts believe XRP could possibly

retest the earlier high of $3.40, depending on how the pattern develops in the

coming weeks.

You may find it interesting at FinanceMagnates.com: Why

Is Crypto Going Up Today? Bitcoin Hits ATH, XRP at 2-Month High, Ethereum and

Dogecoin Follow.

🚨 Grayscale pushes SEC to lift pause on its multi-crypto ETF.Lawyers call the delay harmful to investors & threaten legal action.The fund includes $BTC, $ETH, $SOL, $ADA, $XRP.Could this unlock the door for $DOGE, $PENGU & others? 👀 pic.twitter.com/Rla1Xr8oac

— CryptoPotato Official (@Crypto_Potato) July 11, 2025

Legal Team Presses for Approval Recognition

Grayscale’s legal team has argued that the approval should

be considered final, as the SEC missed its legal deadline to act. The company

has requested that the SEC recognize the approval as effective and is exploring

legal options to lift the stay and move forward with the fund.

Regulatory Pause May Impact Other Products

The SEC’s pause may delay the launch of similar products,

creating uncertainty around regulated access to digital assets. The case

highlights regulatory challenges for crypto-related funds and may influence

future decisions on digital investment products.

This article was written by Tareq Sikder at www.financemagnates.com.

Feed from Financemagnates.com

“Costs Could Reach 25%”: FMAS:25 Panel Urges Cheaper Cross-Border Solutions for Africa’s $50B Remittances

July 14, 2025 7:59 pm | FOREX NEWS

As Africa races ahead in digital finance, a panel of

speakers gathered at Finance

Magnates Africa Summit 2025 to assess the continent’s trajectory—from

inclusion to innovation. Titled “Pay it Forward: Africa’s Leap Toward Digital

Finance,” the session offered a panoramic view of the region’s payment

progression, framed by both optimism and realism.

Moderated by Hannalie Marsh, Ambassador of Women in Payments

Africa, the discussion featured Gabriel Swanepoel, Country Manager for Southern

Africa at Mastercard. Their message was clear: Africa’s digital moment is now,

but execution must match ambition.

From Access to Impact

The panel opened by examining Africa’s unique demographics,

a youthful population and diverse regulatory patchwork, which together present

both a challenge and a catalyst.

“Convergence is key,” the panel noted, urging a shift in

narrative. “The question is no longer just about smartphone penetration but how

we meet consumers where they are in their daily lives.”

That shift, from infrastructure to impact, was central. Mastercard’s

Mobilizing Access in the Digital Economy (MAiD) initiative was held up as a

working model. Designed to support underserved populations, particularly

smallholder farmers and women entrepreneurs. MAiD links digital identity to a

store of value, turning informal commerce into a trackable, bankable activity.

“By linking digital identity with a store of value, we

enable invisible trade to become visible, opening doors to credit and new

markets,” the panel explained.

Fixing the Pipes: Cross-Border Payments and Remittances

While the discussion acknowledged progress, it also returned

repeatedly to the persistent inefficiencies in cross-border transactions—an

area with more urgency than innovation. Africa receives more than $50 billion

in remittances annually, yet the cost of transferring funds across borders

remains prohibitively high in many corridors.

“Costs are still high, up to 25% in some corridors, but

digital solutions are driving them down,” the panel noted, citing Mastercard

Move as a key enabler. The platform aims to streamline corridors and improve

interoperability, long a pain point in African payment systems.

You may find it interesting at FinanceMagnates.com: “Calling

All Crypto Transactions Externalization Would Be Very Limiting,” Warns FMAS:25

Panel.

E-Commerce and Real-Time Payments Take Flight

The consumer side of Africa’s digital economy is growing

rapidly. With e-commerce expanding at over 30% per year, digitally native

buyers are shaping market behavior and expectations. The panel pointed to

Shoprite’s 60/60 delivery bikes as emblematic of this momentum.

“The Shoprite 60/60 delivery bikes are a testament to this

shift,” the panel said, underscoring the region’s embrace of convenience and

immediacy.

This push for speed also extends to payments. But real-time

settlement brings its own challenges.

“Merchants want instant settlement; consumers want

protection. The industry must align on standards,” the panel observed,

highlighting the need for coordinated action across the ecosystem.

Guardrails for the Road Ahead

No conversation on digital finance in 2025 is complete

without touching on AI—and its dual-use nature. Fraud, driven by increasingly

sophisticated tools, is a growing threat. “As fraudsters get smarter, so must our tools,” the panel

warned, urging industry-wide collaboration on security protocols and fraud

detection.

Looking forward, the panel envisioned not just more

digitization but a transformation of commerce itself. The rise of agentic

commerce, AI-powered

assistants handling transactions seamlessly on behalf of users, was flagged

as a major upcoming trend.

“We are entering an era where your digital agent could make

purchases, settle bills, or manage investments,” the panel said.

A Call to Keep the Momentum Inclusive

Closing the session, Marsh urged the audience to maintain

the momentum—but with intent. “Africa’s digital finance journey is accelerating; let’s

ensure it’s inclusive and secure.” With that, the conversation concluded not with finality but

with a call to action. As Africa embraces the tools of tomorrow, it must ensure

no one is left behind.

This article was written by Tareq Sikder at www.financemagnates.com.

Feed from Financemagnates.com

Yes… It is time for US quarterly earnings

July 14, 2025 6:55 pm | FOREX NEWS

Yes… It is time for earnings again. The big banks and financial institutions will kick-off the earnings for the current quarter along with 20% of the Dow 30 scheduled to report (which is six stocks marked by * in the list below).

What is expected?

Tuesday:

- J.P. Morgan*

- Wells Fargo

- JB Hunt

- BlackRock

- Bank of New York

- Citicorp

Wednesday:

- United Airlines

- PNC

- Goldman Sachs*

- Bank of America

- Morgan Stanley

- Johnson & Johnson *

Thursday

- Travelers*

- Netflix

- PepsiCo

- GE Aerospace

- Taiwan Semiconductor

- U.S. Bancorp

Friday

- Comerica

- Charles Schwab

- American Express*

- 3M*

Looking at the key releases and events the US CPI and PPI data will highlight the releases on Tuesday at 8:30 AM and Wednesday at 8:30 AM respectively

- Canada CPI – Tuesday, July 15 at 8:30am ETCanada’s inflation data will be closely watched, with headline CPI m/m expected at 0.2%, down from 0.6% previously. Both Median and Trimmed CPI y/y are forecast to remain steady at 3.0%, signaling a still-elevated but stable inflation environment. A softer print could strengthen the case for the Bank of Canada to consider further easing, while any upside surprise may delay those expectations.

- US CPI – Tuesday, July 15at 8:30 AM ETUS inflation is also in focus and the key release for the week with Core CPI m/m and headline CPI m/m both expected to rise 0.3%, up from 0.1% last month. The y/y CPI is forecast at 2.6%, ticking up from 2.4%. A hotter-than-expected print could weigh on Fed rate cut expectations, while a softer release would support the ongoing disinflation narrative and increase the hollers for a rate cut from Pres. Trump and other government officials

- BOE Gov Bailey Speaks at 4 PM Annual Mansion House Financial and Professional Services Dinner, in London. Markets will listen closely to Bailey’s comments for any clues on timing for future rate adjustments.

- UK CPI – Wednesday, July 16 at 2 AM ETUK CPI y/y is expected to remain unchanged at 3.4%, keeping the pressure on the BOE as inflation stays above target. Markets will listen closely to Bailey’s comments for any clues on timing for future rate adjustments.

- US PPI – Wednesday, July 16 at 8:30am ETProducer inflation is projected to edge higher, with Core PPI m/m forecast at 0.2% and headline PPI m/m at 0.3%, both slightly above last month’s 0.1%. While not as market-moving as CPI, these figures offer insight into upstream pricing pressures. The pieces of the CPI and the PPI will have the number crunchers forecasting the PCE data to be released later in the month. That inflation measure is the favored by the Fed.

- Australia Jobs Report – Wednesday, July 16 at 9:30pm ET (Thursday morning in Australia)Australia’s labor market is expected to show a solid rebound, with 21.0K jobs added, compared to a -2.5K loss previously. The unemployment rate is expected to hold steady at 4.1%. A strong report could support the RBA’s neutral-to-hawkish stance, while a weak print may reignite easing discussions.

- US Retail Sales & Jobless Claims – Thursday, July 17 at 8:30am ETConsumer spending is expected to recover modestly, with Core Retail Sales forecast at 0.3% m/m and headline Retail Sales at 0.2% m/m, following last month’s declines. Meanwhile, unemployment claims are projected to rise slightly to 234K from 227K. The data will help shape expectations around consumer resilience and labor market conditions heading into Q3.

Other second tier data on tap next week includes:

- China Data – Monday, July 14China will release a batch of key economic figures, including GDP y/y (expected at 5.1%), Industrial Production y/y (5.6%), and Retail Sales y/y (5.2%), all showing slight deceleration from the prior month. However, New Loans surged to 1960B, up sharply from 620B, suggesting increased credit support. These figures will offer insight into the health of China’s economy and its momentum heading into H2.

- German ZEW Economic Sentiment – Tuesday, July 15 at 5:00am ETGermany’s ZEW Economic Sentiment index is expected to rise to 50.8 from 47.5, reflecting growing optimism among investors and analysts about the German economic outlook despite broader European uncertainties.

- Empire State Manufacturing Index – Tuesday, July 15 at 8:30am ETThe Empire State Manufacturing Index is projected to improve to -7.8 from -16.0, but still remains in contraction territory. While less negative, this suggests manufacturing activity in New York remains sluggish. The NY kicks off the regional indices for the month

- UK Labor Data – Thursday, July 17 at 2 AM ETUK wage pressures are expected to ease slightly, with the Average Earnings Index (3m/y) falling to 5.0% from 5.3%, while the Claimant Count Change is forecast at 17.9K, down from 33.1K. This will offer an updated look at the UK’s labor market tightness and its implications for BOE policy.

- Philly Fed Manufacturing Index – Thursday, July 17 at 8:30am ETThe Philly Fed Index is forecast to rebound to 0.4 from -4.0, possibly signaling a modest recovery in regional manufacturing conditions after recent weakness.

- Fed Speak – Thursday, July 17 at 3:30pm ETFOMC member Waller will speak, and markets will be listening closely for any updated views on the path of rate cuts, especially following key CPI and labor data earlier in the week.Waller has been a dove and coming after the June CPI and PPI data, his comments will be eyed for his current assessment for a policy change in July.

- UoM Consumer Sentiment & Inflation Expectations – Friday, July 18 at 10:00am ETThe University of Michigan Consumer Sentiment Index is expected to rise slightly to 61.4 from 60.7, suggesting a modest improvement in consumer outlook. Inflation expectations are projected to remain steady at 5.0%, a key metric for Fed watchers.

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

BOEs Bailey: Uncertainty continues to weigh on growth expectations

July 14, 2025 6:52 pm | FOREX NEWS

BOE’s Bailey ins a letter to G20 finance ministers and central bank governors:

- Since April, market conditions have improved and asset prices have recovered

- We have seen further economic and geopolitical risks crystallize and global debt vulnerabilities remain high.

- Uncertainty continues to weigh on growth expectations.

- We need to remain vigilant to the rest of disruptive market moves.

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

Silver’s Shine Attracts Investors. Forecast as of 11.07.2025

July 14, 2025 6:43 pm | FOREX NEWS

Rising investment demand, the “Trump Always Chickens Out” (TACO) trading, as well as signs of fiscal dominance, have pushed XAGUSD quotes to 13-year highs. Will this rally sustain, or is it time to lock in profits? Let’s discuss this topic and make a trading plan. Major Takeaways Capital inflows into ETFs exceeded 95 million ounces in six months. Speculators have increased their long positions in silver by 163% since the beginning of the year. Silver is still undervalued compared to gold. Long positions on the XAGUSD can be considered with a target of $40. Monthly Fundamental Forecast for Silver In… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com