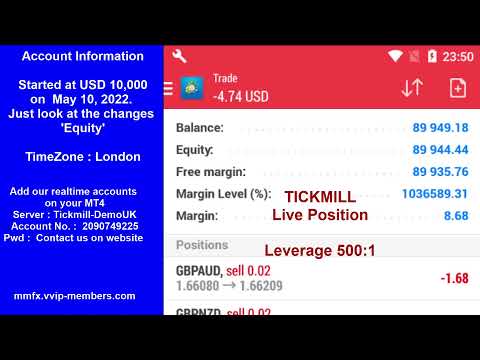

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Visit website for more information.

https://mmfx.vvip-members.com/ Contact us

moneymakerfxea@gmail.com

MoneyMaker FX EA Trading Robot

FOREX NEWS & BLOG

MoneyMaker FX EA Trading Robot님의 실시간 스트림

September 24, 2022 3:49 pm | Uncategorized

Forex EA Trading Robot

https://mmfx.vvip-members.com/ If your account balance is less than US$3,000, open an FBS Cent account via the link below.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en If your account balance is more than US$30,000, open an Tickmill Pro or VIP account via the link below.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=https%3A%2F%2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA Trading Robot

Chart Art: Bitcoin (BTC/USD) Triangle Breakout Soon?

February 25, 2026 3:56 am | FOREX NEWS

After weeks of steady declines, bitcoin is taking a quick breather inside a triangle consolidation pattern. Which way could it break out next?

Feed from Babypips.com

PBOC sets USD/CNY reference rate at 6.9321 vs. 6.9414 previous

February 25, 2026 3:45 am | FOREX NEWS

The People’s Bank of China (PBOC) sets the USD/CNY central rate for the trading session ahead on Wednesday at 6.9321 compared to the previous day’s fix of 6.9414 and 6.8824 Reuters estimate.

Feed from Fxstreet.com

WTI declines to near $66.00 on US crude stock surge, traders monitor US-Iran developments

February 25, 2026 3:23 am | FOREX NEWS

West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $66.05 during the early Asian trading hours on Wednesday. The WTI price declines amid a significant build in US crude stockpiles.

Feed from Fxstreet.com

AUD/JPY holds gains above 110.00 following Australia’s CPI data

February 25, 2026 3:13 am | FOREX NEWS

AUD/JPY extends its gains for the second successive session, trading around 110.10 during the Asian hours on Wednesday.

Feed from Fxstreet.com

Weekly Economic Calendar for 02.03.2026–08.03.2026

February 25, 2026 3:08 am | FOREX NEWS

Geopolitical tensions, moves by the US administration, Trump’s erratic rhetoric, conflicting macro data, and a steady stream of headlines, especially around the Fed, continue to shake the markets. In this environment, only one trend has remained consistent so far: the ongoing decline in cryptocurrencies. Unlike gold, which has once again climbed above the 5,000.00–5,100.00 range, Bitcoin continues to fall. It has not shown that it can act as a reliable hedge, and its decline is weighing on almost the entire cryptocurrency market. As for traditional assets and major currencies, trading remains relatively stable. Bulls and bears continue to compete, and… Read full author’s opinion and review in blog of #LiteFinance

Feed from Litefinance.com

TA Alert of the Day: Bullish EMA Crossover Puts Silver Back on Upside Watch

February 25, 2026 1:57 am | FOREX NEWS

Silver has triggered a bullish moving average crossover on the daily chart, signaling improving short-term momentum and potential upside continuation. Will price build follow-through or fade back into consolidation and negate the signal?

Feed from Babypips.com

Indonesia: Deficit set to widen – UOB

February 25, 2026 1:33 am | FOREX NEWS

UOB Global Economics & Markets Research economists Enrico Tanuwidjaja and Vincentius Ming Shen note that Indonesia’s current account moved back into a small deficit in 4Q25 and for full-year 2025.

Feed from Fxstreet.com

Financial & Forex Market Recap: Feb. 24, 2026

February 25, 2026 1:28 am | FOREX NEWS

Tech stocks power recovery after AI fears ease while dollar trades mixed on dovish Fed commentary; traders await Trump’s State of the Union for policy clarity.

Feed from Babypips.com

Romania: Growth shift and AI reshape jobs – ING

February 24, 2026 7:34 pm | FOREX NEWS

ING economists Valentin Tataru and Stefan Posea describe Romania’s shift from a consumption-driven, labour‑intensive model toward a capital‑intensive, productivity‑based economy.

Feed from Fxstreet.com

BoE’s Governor Bailey: Rate cut at next meeting is a genuinely open question

February 24, 2026 6:47 pm | FOREX NEWS

Bank of England (BoE) Governor Andrew Bailey said on Tuesday that he expects inflation to return to close to target in April. During his testimony before the parliament’s Treasury committee, he added that a possible rate cut in March is “a genuinely open question.”

Feed from Fxstreet.com

BoE’s Pill: Bearing down on inflationary pressures remains necessary

February 24, 2026 6:28 pm | FOREX NEWS

Bank of England (BoE) Chief Economist Huw Pill said that the BoE has put too much weight on inflation being near the target rather than looking ahead, in remarks at the parliament’s Treasury Committee on Tuesday.

Feed from Fxstreet.com

Brazil: Tariff relief but lingering US risk – Standard Chartered

February 24, 2026 5:56 pm | FOREX NEWS

Standard Chartered economist Dan Pan argues that Brazil stands out as a major beneficiary of the US Supreme Court ruling against President Trump’s IEEPA tariffs, with effective tariffs likely to fall sharply.

Feed from Fxstreet.com