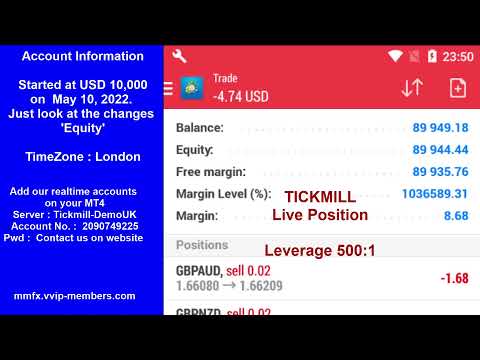

MoneyMaker FX Expert Advisor Robot Trading Account Live Streaming Qo'shimcha ma'lumot olish uchun veb-saytga tashrif buyuring.

https://mmfx.vvip-members.com/ Biz bilan bog'laning

moneymakerfxea@gmail.com

MoneyMaker FX EA savdo roboti

FOREX YANGILIKLARI VA BLOG

MoneyMaker FX EA savdo robotining jonli efiri

2022-yil 24-sentabr, 15:49 | Kategoriyasiz

Forex EA savdo roboti

https://mmfx.vvip-members.com/ Agar hisobingizdagi balans 3000 AQSh dollaridan kam bo'lsa, quyidagi havola orqali FBS Cent hisobini oching.

https://fbs.com/cabinet/registration/trader/?ppu=9438088&account=stand&lang=en Agar hisobingizdagi balans 30 000 AQSh dollaridan ortiq bo'lsa, quyidagi havola orqali Tickmill Pro yoki VIP hisobini oching.

https://secure.tickmill.com/?utm_campaign=ib_link&utm_content=IB79616275&utm_medium=%EA%B3%84%EC%A0%95+%EC%9C%A0%ED%98%95&utm_source=link&lp=2Fs%3A %2Ftickmill.com%2Fen%2Faccounts%2F

MoneyMaker FX EA savdo roboti

FX Weekly Recap: July 22 – 26, 2024

July 27, 2024 2:04 am | FOREX YANGILIKLARI

The Japanese yen found itself at the top of the daily leaderboard thanks to calls for BOJ tightening and a big return in broad negative risk sentiment.

Babypips.com saytidan tasma

The AUD is the strongest and the JPY is the weakest as the NA session begins.

July 27, 2024 1:54 am | FOREX YANGILIKLARI

As the North American session begins, the AUD is the strongest and the JPY is the weakest. That combination reverses what has been more of a familiar theme with the AUD (or NZD) weakest and the JPY the strongest. Not surprisingly, there is a rebound in US stocks in the pre-market which is helping the reversal. The Nasdaq is up 200 points (currently) in premarket futures trading. That reverses the -160 point decline from yesterday. Nevertheless, the major US indices are on pace for a declines this week.

The unwind of the USDJPY and the so called “carry trade” where some investors borrow the yen at low rates to invest in USD assets (or other countries assets) for better returns,has been an excuse for the flow of funds out of some assets and into others.Having said that, the Nikkei 225 had its worst day since 2021 this week. Bitcoin, oil, silver, copper and even gold fell this week. So there may be selling of the USD and liquidation in things like the US stocks but it seems to be going into cash. It will be interested how this story unwinds.

Of course, when you have moves like we have had this week especially out of assets like the Magnificent 7, it is always fun to find the “reason” (i.e. carry trade unwind), but it just can be “taking profit” and yes parking in cash or money market for a while. The Fed does meet next week, and with 2% or thereabout growth in the 1H of 2024, it may make it hard to cut. So parking funds for a while and buy a dip might be a sound idea.

BTW, The BOJ does meet next week,and the market is pricing in a 65% chance for a 10 basis point rise in rates. The US Fed also meets and the focus by the markets is on the central bank starting the cuts in September.

Today’s data, may help the Fed with that decision as the favored measure of inflation (the core PCE) will be released at 8:30 AM ET. A review of the economic data to be released today, will be highlighted by the PCE data along with the University of Michigan consumer sentiment (final) at 10 AM ET. :

- PCE price index MoM: Forecast 0.1% versus 0.0% last month. YoY estimate 2.5% versus 2.6% last month.

- Core PCE Price Index m/m: Forecast 0.2% versus 0.1% last month. Estimate 2.5% versus 2.6% last month

- Personal Income m/m: Estimate 0.4% versus 0.5% last month

- Personal Spending m/m: Estimate 0.3% versus 0.2% last month

- Revised UoM Consumer Sentiment: Estimate 66.0 versus 68.2 last month and 66.0 preliminary

- Revised current conditions: Preliminary 64.1. Last month 65.9

- Revised expectations: Preliminary 67.2. Last month 69.6

- 1 year inflation expectations. Preliminary 2.9% versus 3.0% last month

- 5 year inflation expectations. Preliminary 2.9% versus 3.0% last month

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $0.37 at $77.91. Although lower today, at this time yesterday, the price was even lower at $76.36. The price is down -0.80% for the week

- Gold is trading up $7.80 or 0.33% at $2373. At this time yesterday, the price was trading at $2371.44. For the week the price of gold is down -1.07%.

- Silver is trading down eight cents or -0.32% at $27.73. At this time yesterday, the price is trading at $27.57. For the week the price of silver has tumbled -5.02% which comes after 8-5.10% decline last week.

- Bitcoin trading higher at $67,298 (well there is some buying in bitcoin today) . At this time yesterday, the price was trading at $64,208

- Ethereum is trading higher as well as $3246. At this time yesterday, the price was trading at $3174.03

In the premarket, the snapshot of the major indices are trading higher.

- Dow Industrial Average futures are implying a gain of 287.93 points. Yesterday, the Dow Industrial Average rebounded with a gain of 81.20 points or 0.20% to 39935.08.

- S&P futures are implying a gain of 47.78 points erasing the declines from yesterday. Yesterday, the S&P index closed lower by -27.89 points or -0.51% at 5399.23. The S&P is on pace for back-to-back weeks of 2% declines.

- Nasdaq futures are implying a gain of 223 points . Yesterday, the index closed lower by -160.69 points or -0.93% at 17181.72. Coming into today (with the gains, it may not play out), the NASDAQ was on pace for back-to-back weeks of -3% declines (at the close yesterday the index was down -3.08% after falling -3.68% last week). It hasn’t done that since September 2022.

- Yesterday, the Russell 2000 index rose by 27.60 points or 1.26% at 2222.98.

European stock indices are trading mostly higher. For the week the indices are also mixed:

- German DAX, +0.49%. The index is up 1.19% this week.

- France CAC, +0.91%. The index is down -0.56% this week.

- UK FTSE 100, +0.85%. The index is up 1.22%.

- Spain’s Ibex, -0.07%. The index is up 0.44% this week.

- Italy’s FTSE MIB, +0.25% (delayed 10 minutes). The index is down -1.01 percent this week

Shares in the Asian Pacific markets closed lower:.

- Japan’s Nikkei 225, -0.53%. For the week the Nikkei fell -5.98% it’s worse decline since April 15 week when it tumbled -6.21%.

- China’s Shanghai Composite Index, +0.14%. For the week it fell -3.06%.

- Hong Kong’s Hang Seng index, +0.10%. For the week it fell -2.28%.

- Australia S&P/ASX index, +0.76%. For the week the index fell -0.60%.

Looking at the US debt market, yields are trading mixed:

- 2-year yield 4.434%, -0.8 basis points. At this time yesterday, the yield was at 4.366%. 2-year yield are currently down -7.8 basis points this week

- 5-year yield 4.132%, -1.2 base points. At this time yesterday, the yield was at 4.088%. Currently the 5-year yield is down -3.6 basis points this week.

- 10-year yield 4.240%, -1.5 basis points. At this time yesterday, the yield was at 4.225%. Currently, the 10 year yield is unchanged this week

- 30-year yield 4.481%, -1.9 basis points. At this time yesterday, the yield was at 4.495%. Currently, the 30-year yield is up 3.4 basis points.

Looking at the treasury yield curve,

- The 2-10 year spread is at -19.6 basis points. At this time yesterday, the spread was at -14.4 basis points. Currently, the spread is up 8.0 basis points this week

- The 2-30 year spread is +4.5 basis points. At this time yesterday, the spread was 12.6 basis points. Currently, the spread is up 11.0 basis points this week

In the European debt market, the benchmark 10-year yields are lower:

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

Yellen says Japan explained 2022 FX intervention, Nikkei reports

July 27, 2024 1:44 am | FOREX YANGILIKLARI

Global Market Weekly Recap: July 22 – 26, 2024

July 27, 2024 1:43 am | FOREX YANGILIKLARI

Market correlations fell in & out of sync & broad risk vibes were soured as traders juggled several major market narratives, including fears of a slowdown in China.

Babypips.com saytidan tasma

US stocks close the week with gains on the day. S&P and Nasdaq lower for the week.

July 26, 2024 11:40 pm | FOREX YANGILIKLARI

The US stocks have closed the week with gains on the day.

The S&P and the Nasdaq remain lower on the week. The Dow and the small-cap Russell 2000 closed higher with the Russell 2000 the best performer on the rotation on hopes lower rates would help those companies going forward.

The final numbers are showing:

- Dow industrial average rose 654.27 points or 1.64% at 40,589.35.

- S&P index rose 59.86 points or 1.11% at 5459.09

- NASDAQ index rose 176.16 points or 1.03%17357.88

The small-cap Russell 2000 rose to 37.08 points or 1.67% at 2260.06.

For the trading week:

- Dow Industrial Average average rose 0.75%.The Dow closed higher for the fourth consecutive week

- S&P index fell -0.83%. The S&P index fell for the second consecutive week.

- NASDAQ index-2.08%. The NASDAQ index fell for the second consecutive week.

- Russell 2000 rose 3.466% and for the third consecutive week.

Next week is a huge week with Amazon, Apple, Meta Platforms, and Microsoft all scheduled to release earnings.

Today:

- Meta Platforms +2.75%

- Amazon, +1.47%

- Alphabet -0.17%

- Apple +0.22%

- Microsoft +1.64%

- Tesla -0.20%

- Nvidia +0.71%

For a list of the other companies scheduled to release can be found HERE. Of course the Fed interest rate decision on Wednesday will also be a key event. The week will also end with the US jobs report on Friday (177K estimate with the unemployment rate at 4.1%).

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

CNY: No turning point – Commerzbank

July 26, 2024 11:32 pm | FOREX YANGILIKLARI

Yesterday morning, the CNY was able to take advantage of the JPY’s strength against the US Dollar and also appreciated significantly against the greenback.

Fxstreet.com saytidan tasma

US inflation (PCE) data due imminently – here is the critical range to watch

July 26, 2024 11:29 pm | FOREX YANGILIKLARI

I posted this during the Asian time zone, repeating it here. Before I do, check this out:

—

Due at 0830 US Eastern time, the Core PCE data is the focus. You can see the median estimates below in the table.

The ranges (why these are important is explained below) of estimates are:

Core PCE Price Index m/m

- -0.1% to +0.2%

and for the y/y

- 2.4% to 2.6%

- This snapshot is from the ForexLive economic data calendar, access it here.

- The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that is the consensus median expected.

***

Why is knowledge of such ranges important?

Data results that fall outside of market low and high expectations tend to move markets more significantly for several reasons:

-

Surprise Factor: Markets often price in expectations based on forecasts and previous trends. When data significantly deviates from these expectations, it creates a surprise effect. This can lead to rapid revaluation of assets as investors and traders reassess their positions based on the new information.

-

Psychological Impact: Investors and traders are influenced by psychological factors. Extreme data points can evoke strong emotional reactions, leading to overreactions in the market. This can amplify market movements, especially in the short term.

-

Risk Reassessment: Unexpected data can lead to a reassessment of risk. If data significantly underperforms or outperforms expectations, it can change the perceived risk of certain investments. For instance, better-than-expected economic data may reduce the perceived risk of investing in equities, leading to a market rally.

-

Triggering of Automated Trading: In today’s markets, a significant portion of trading is done by algorithms. These automated systems often have pre-set conditions or thresholds that, when triggered by unexpected data, can lead to large-scale buying or selling.

-

Impact on Monetary and Fiscal Policies: Data that is significantly off from expectations can influence the policies of central banks and governments. For example, in the case of the inflation data due today, weaker than expected will fuel speculation of nearer and larger Federal Open Market Committee (FOMC) rate cuts. A stronger (i.e. higher) CPI report will diminish such expectations.

-

Liquidity and Market Depth: In some cases, extreme data points can affect market liquidity. If the data is unexpected enough, it might lead to a temporary imbalance in buyers and sellers, causing larger market moves until a new equilibrium is found.

-

Chain Reactions and Correlations: Financial markets are interconnected. A significant move in one market or asset class due to unexpected data can lead to correlated moves in other markets, amplifying the overall market impact.

This article was written by Eamonn Sheridan at www.forexlive.com.

Feed from Forexlive.com

Forexlive Americas FX news wrap 26 Jul: Rebound day. AUD higher. CHF lower. Stocks rise

July 26, 2024 11:29 pm | FOREX YANGILIKLARI

- US stocks close the week with gains on the day. S&P and Nasdaq lower for the week.

- Next week will be the Grand Daddy of the earning calendar this quarter

- Baker Hughes oil rig count +5 to 482.

- ECBs Schnabel:Services inflation showing last mile in inflation fight especially difficult

- European shares bounce back. Mixed performance for the week.

- Initial Atlanta Fed GDPNow growth tracker comes in at 2.8%

- University of Michigan consumer sentiment for July 66.4 versus 66.0 estimate (and prelim)

- Kickstart the FX trading day for July 26 w/a technical look at the EURUSD, USDJPY & GBPUSD

- US Core PCE YoY for June 2.6% versus 2.5% estimate

- The AUD is the strongest and the JPY is the weakest as the NA session begins.

- ForexLive European FX news wrap: A bit of respite ahead of the US PCE report

For most of the week, the flow of funds sent the JPY and CHF higher on flight to safety flows. The AUD (and NZD) lower as risk off sentiment dominated on the back of slowdown in China, lower commodities and stocks moving lower.

Today saw a reversal of some of those trends.

For the day, the AUDSD is the strongest of the majors. The CHF is ending as the weakest. The JPY is ending the day mixed. The USD which was mixed for a lot of the week is ending the week with the same fortunes today.

Stocks moved higher in both Europe and the US today.

The major European indices bounced back in trading today with all the indices higher.

- German DAX, +0.68%

- France CAC +1.22%

- UK FTSE 100 +1.21%

- Spain’s Ibex +0.18%

- Italy’s FTSE MIB +0.12%

For the trading week, most of the indices were higher except Italy’s FTSE MIB

- German DAX +1.38%

- France CAC, -0.22%

- UK FTSE 100, +1.59%

- Spain’s Ibex, +0.71%

- Italy’s FTSE MIB, -1.09%

The final numbers in the US closed the day with gains across the board.

- Dow industrial average rose 654.27 points or 1.64% at 40,589.35.

- S&P index rose 59.86 points or 1.11% at 5459.09

- NASDAQ index rose 176.16 points or 1.03% at 17357.88

- The small-cap Russell 2000 rose to 37.08 points or 1.67% at 2260.06.

For the trading week, the results were mixed with the Dow up for the 4th consecutive week. The Russell 2000 was up for the 3rd week.. The S&P and the Nasdaq were down for the 2nd consecutive week. Next week will be influenced by a slew of earnings highlighted by Microsoft, Apple, Amazon and Amazon amongst other large cap titans in various industries.

US yields are closing the day near lows across the yield curve:

- 2 year yield 4.389%, -5.4 basis points

- 5-year yield 4.0767%, -6.8 basis points

- 10-year yield 4.195%, -6.0 basis points

- 30-year yield 4.456%, -4.4 basis points

For the trading week:

- 2-year yield -13 basis points

- 5-year yield, -9.4 basis points

- 10-year yield, -4.7 basis points

- 30-year yield, unchanged.

The 2-10 year rose by 8.3 basis points for the week to -19.4 basis pointe. The 2-30 year spread is ending positive by 6.7 basis points.

Fundamentally today, the PCE data was consistent with the PCE data from the GDP data yesterday.

The core PCE moved up by 0.188% (rounded to 0.2%. The YoY rose by 2.6%. The was unchanged from last month. The headline PCE rose of 0.1% (revised higher) with the YoY dipping to 2.5% from 2.6%.

The Michigan consumer survey data was mixed with the sentiment moving higher vs the preliminary, the current conditions lower and the expectations higher . Inflation results were more or less as expected and close to last months levels.

IN addition to the parade of earnings, the Fed, the Bank of England and the Bank of Japan will announce interest rate decision. The US jobs report will be released on Friday. Australia and EU CPI will be released. China PMI will be released as well.

Thank you for the support.this week. Wishing you all a great weekend (PS enjoy the Olympics).

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

AUD/USD remains steady near 0.6550 after mix US PCE Inflation report

July 26, 2024 11:21 pm | FOREX YANGILIKLARI

The AUD/USD pair remains steady above the immediate support of 0.6520 in Friday’s New York session after the release of the mixed United States (US) Personal Consumption Expenditure Inflation (PCE) report for June.

Fxstreet.com saytidan tasma

A technical look at each of the major currency pairs heading into the new trading week

July 26, 2024 10:51 pm | FOREX YANGILIKLARI

EURUSD

USDJPY:

GBPUSD:

USDCHF:

USDCAD:

AUDUSD and NZDUSD

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

US PCE data is the key release today

July 26, 2024 10:01 pm | FOREX YANGILIKLARI

Today’s data, may help the Fed with their decision next week (and going forward), as the “favored measure of inflation” (the core PCE) will be released at 8:30 AM ET.

A review of the economic data to be released today, will be highlighted by that PCE data (and Personal income and spending) along with the University of Michigan consumer sentiment (final) at 10 AM ET. I have been hearing how the core PCE will be 0.18% but the Reuters estimate has it at 0.1%. Be aware.

- PCE price index MoM: Forecast 0.1% versus 0.0% last month. YoY estimate 2.5% versus 2.6% last month.

- Core PCE Price Index m/m: Forecast 0.2% versus 0.1% last month. Estimate 2.5% versus 2.6% last month

- Personal Income m/m: Estimate 0.4% versus 0.5% last month

- Personal Spending m/m: Estimate 0.3% versus 0.2% last month

- Revised UoM Consumer Sentiment: Estimate 66.0 versus 68.2 last month and 66.0 preliminary

- Revised current conditions: Preliminary 64.1. Last month 65.9

- Revised expectations: Preliminary 67.2. Last month 69.6

- 1-year inflation expectations. Preliminary 2.9% versus 3.0% last month

- 5-year inflation expectations. Preliminary 2.9% versus 3.0% last month

This article was written by Greg Michalowski at www.forexlive.com.

Feed from Forexlive.com

JPY: Lots of hope – Commerzbank

July 26, 2024 9:53 pm | FOREX YANGILIKLARI

Those who still believed that the JPY’s rally was due to idiosyncratic factors that only affect the Japanese currency were disabused of that notion by 2:30 p.m.

Fxstreet.com saytidan tasma